2021 CIRT Sentiment Index: First Quarter Report

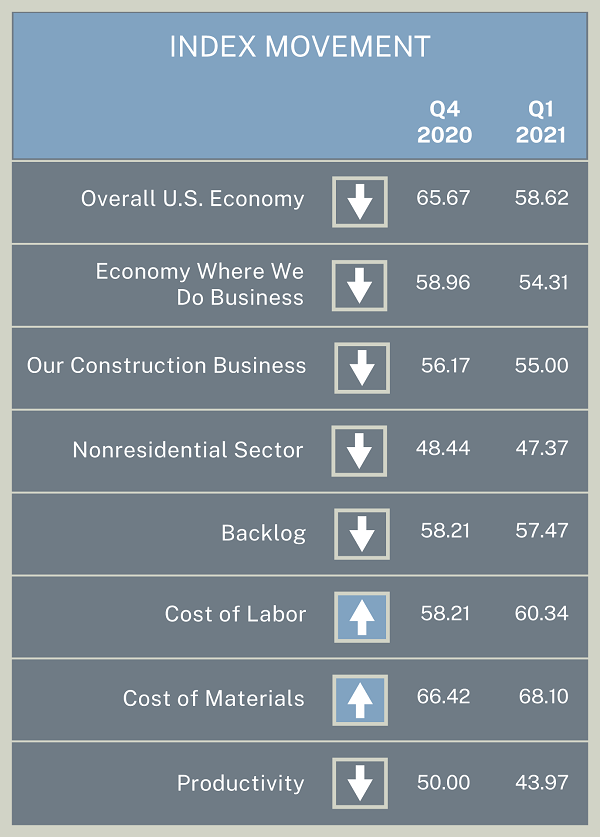

The first quarter of 2021 results show signs of stabilization and some amount of recovering confidence for both the Sentiment Index and the Design Index. The Sentiment Index increased slightly from last quarter, from 54.2 to 55.5, and the Design Index remained constant at 64.8. Both suggest continued and improving demand in the future.

This stability is reflective of the cautious optimism for the year ahead, especially compared to the significant economic losses experienced through 2020. Looking ahead, reduced political uncertainty, beginning phases in deployment of multiple coronavirus vaccines, a second round of government stimulus and improved owner/client confidence will all contribute to heightened expectations.

For first quarter 2021, we polled CIRT membership on various internal metrics, including backlog, firm capacity and hiring goals. Within the report, these results were compared to those collected during first quarter 2020. Current issues questions also asked respondents to identify a variety of top economic risks and policy or regulatory concerns for the year ahead.

- Backlog responses were split almost perfectly into thirds, with 33% of participants having backlogs under 12 months, 31% with backlogs spanning the next 19 months or longer, and a slight majority (35%) having backlogs in the 12–18 month range.

- A majority (59%) of survey participants reported capacity greater than 80%, with most (38%) estimating capacity between 81% and 90%. The remaining 41% estimate capacity at 80% or lower, with a large portion (28%) operating at 70% capacity or lower.

- Hiring goals were split evenly between those increasing their hiring targets and those keeping hiring goals about the same (both groups at 36%). The remaining 28% of respondents indicate somewhat lower (19%) or significantly lower (9%) hiring goals for the new year.

- The most frequently selected economic risk factors for 2021 include the ongoing slowdown (62%), project delays and cancellations (53%), uncertainty about project funding (50%) and increasing competition (43%).

- The most frequently selected political or regulatory concerns include federal infrastructure funding (55%), renewed aggressive regulatory policy (50%), coronavirus response (47%) and tax policy (45%).

Among the industries represented by CIRT’s member base, lodging, commercial, heavy civil and transportation, office and education work are projected to experience the biggest short-term declines across both the design and construction industries. The design industry’s long-term view of project growth remains positive, with every sector tracking above 3.0. The construction industry’s long-term view is similarly optimistic, with just one sector tracking below 3.0 (office).

ABOUT THE CONSTRUCTION INDUSTRY ROUND TABLE (CIRT)

The Construction Industry Round Table (CIRT) is composed exclusively of approximately 115-120 CEOs from the leading architectural, engineering and construction firms doing business in the United States.

CIRT is the only organization that is uniquely situated as a single voice representing the richly diverse and dynamic design/construction community. First organized in 1987 as the Construction Industry Presidents’ Forum, the Forum has since been incorporated as a not-for-profit association with the mission “to be a leading force for positive change in the design/construction industry while helping members improve the overall performance of their individual companies.”

The Round Table strives to create one voice to meet the interests and needs of the design/construction community. CIRT supports its members by actively representing the industry on public policy issues, by improving the image and presence of its leading members, and by providing a forum for enhancing and developing strong management approaches through networking and peer interaction.

The Round Table’s member CEOs serve as prime sources of information, news and background on the design/construction industry and its activities. If you are interested in obtaining more information about the Construction Industry Round Table, please call 202-466-6777 or contact us by email at cirt@cirt.org.

CIRT SENTIMENT INDEX

The CIRT Sentiment Index is a survey of members of the Construction Industry Round Table conducted quarterly by FMI Research, Raleigh, North Carolina. For press contact or questions about the CIRT Sentiment Index, contact Mark Casso at mcasso@cirt.org.

CONFIDENTIALITY

All individual responses to this survey will be confidential and shared outside of FMI only in the aggregate. All names of individuals responding to this survey will remain confidential to FMI.

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at bstrawberry@fminet.com.

Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at ebeardall@fminet.com.