Monthly Construction Input Prices Increase Slightly in September, Led by Higher Energy Prices

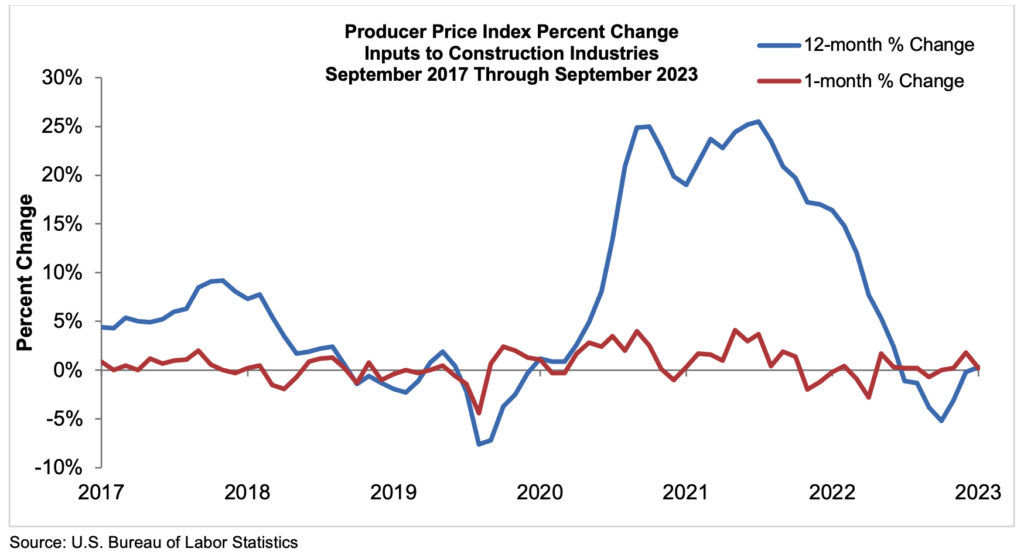

Construction input prices increased 0.2% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices increased 0.2% for the month as well.

Overall construction input prices are 0.3% higher than a year ago, while nonresidential construction input prices are 0.6% higher. Prices increased in all three energy subcategories in September. Crude petroleum prices were up 10.1%, along with unprocessed energy materials prices, which rose 7.5% last month. Natural gas prices were up slightly by 0.1% in September.

“Today’s PPI report indicates that while inflationary pressures persist economywide, materials price increases are no longer at the heart of this bout of excess inflation,” said ABC Chief Economist Anirban Basu. “When inflation began to emerge in 2021, supply chains ill-prepared to handle surging demand for goods and services during the early stages of post-pandemic recovery were among the primary culprits. Today, inflation is driven less by supply chain issues and more by structural labor market dynamics and geopolitics. Many contractors continue to indicate that their primary challenge is securing sufficient levels of workers. That will not change anytime soon and could only be countered by a sharp downturn in construction activity.

“At this time, that sharp downturn is not anticipated,” said Basu. “Rather, contractors continue to report healthy backlog, plentiful bidding opportunities and expectations for sales, employment and profit margin growth during the months ahead, according to ABC’s Construction Confidence Index. Over the past year, materials prices have been roughly flat, though certain segments like concrete have continued to experience upward price pressures. Renewed conflict in parts of the world that produce a considerable amount of global energy could put more pressure on contractors during the months ahead, but such things are difficult to predict.”