ABC’s Construction Backlog Indicator Rebounds in 2017

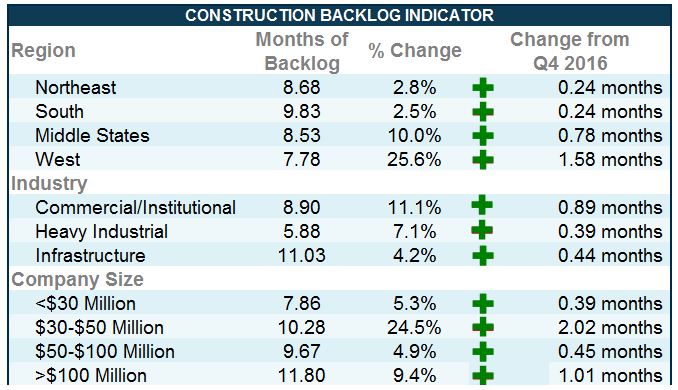

Associated Builders and Contractors (ABC) newly released Construction Backlog Indicator (CBI) rose to 9 months during the first quarter of 2017, up 8.1 percent from the fourth quarter of 2016. CBI is up by 0.4 months, or 4 percent, on a year-over-year basis.

“This was a terrific report,” said ABC Chief Economist Anirban Basu. “For the first time in the series’ history, every category—firm size, industry and region—registered quarterly growth in CBI. Among the big winners were firms in the western United States and those with annual revenues between $30 million and $50 million per annum.

“However, some contractors have expressed concerns regarding construction conditions in 2019 or 2020,” said Basu. “These concerns are rooted in a number of factors, including the already lengthy duration of the economic recovery, evidence of saturation in certain commercial real estate markets, weak momentum in numerous public spending categories and tightening monetary conditions. However, first quarter 2017 CBI strongly suggests that rumors of the business cycle’s demise are exaggerated, at least thus far.

“Because of these and other emerging concerns, ABC’s CBI measure is arguably more important than usual,” said Basu. “Backlog is a leading indicator, and meaningful declines in CBI could potentially confirm fears that the current construction spending expansion cycle is winding to a close.”

Highlights by Region

Surging financial markets helped support activity in financial centers like New York, Philadelphia and Boston. Expanding cyber-security and life sciences activity supported markets as geographically diverse as Washington/Baltimore; Austin, Texas; Silicon Valley, Calif., and Seattle.

Though backlog is slightly lower in the South on a year-over-year basis, it continues to report the lengthiest backlog, at 9.8 months. A number of markets remain extraordinarily active with respect to commercial construction, including Atlanta and Miami and Tampa, Fla. Distribution center construction also continues to be active due to a combination of busier seaports and the ongoing online retail boom.

Backlog in the West was up by a remarkable 26 percent during the quarter. Part of this was due to statistical payback after a surprisingly weak fourth quarter. However, this is also a reflection of the rapid commercial growth in Seattle, Denver, Silicon Valley, San Diego, Phoenix and other population growth hotspots.

Higher oil and natural gas prices helped to drive CBI higher in the Middle States. Backlog in the region expanded by a more-than-respectable 10 percent during the first quarter, and now stands at a healthy 8.5 months. Chicago continues to be a weak spot, however, registering slow job growth relative to other major U.S. metropolitan areas in recent quarters.

Backlog in the Northeast rose to 8.7 months during the first quarter. Backlog is up by almost precisely half a month over the past year. The New York and Boston metropolitan areas remain particularly active.