ABC’s Construction Backlog Indicator Sinks Below Record Highs in Q3 2018

Associated Builders and Contractors reports that its Construction Backlog Indicator contracted to 9.04 months during the third quarter of 2018, down 8.4 percent from the second quarter and 4.3 percent lower than the same time last year.

“Construction backlog reached its highest level ever during the second quarter,” said ABC Chief Economist Anirban Basu. “While the third quarter saw average

ABC Chief Economist Anirban Basu

contractor backlog shrink, the indicator remains elevated by historical standards and remains above nine months for only the fourth time in the 10-year history of the series.

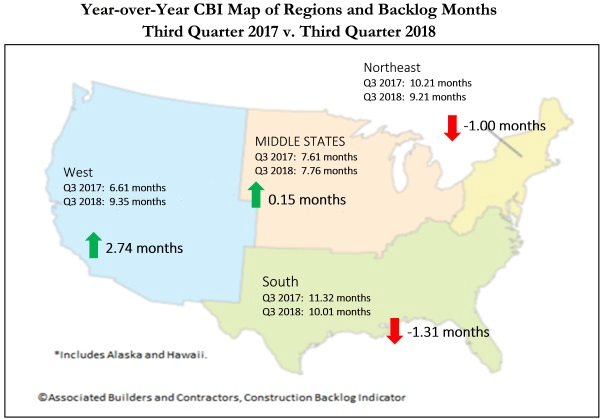

“That said, third-quarter declines were widespread,” Basu said. “On a quarterly basis, backlog decreased in three out of four major regional designations. The exception was the Middle States, where a surge in industrial production has helped bolster economic activity.

“Backlog in the infrastructure category fell below the 10-month threshold for the first time since the third quarter of 2015. This may be the result of a temporary expansion in infrastructure-related spending due to rebuilding efforts following natural disasters in parts of Texas, Florida, California and other states in recent years, as well as an ensuing reversal in the volume of new contractual activity, which is likely temporary.

“By contrast, backlog in the commercial/institutional and heavy industrial categories remains elevated by historic standards. Backlog in the heavy industrial segment remains more than two months above the Q3 2017 level.”

Highlights by Region

· Backlog in the South decreased by more than a full month during the third quarter of 2018. Despite being down roughly 10 percent (quarterly and year over year), the South’s backlog remains the highest of any of the four major regions. That said, the peak of construction spending growth in the South might be behind us.

· Backlog in the Northeast contracted by more than a full month after reaching its highest level ever during the second quarter of 2018. There are likely many reasons for this, including a recent slowing in global investment in Northeast commercial real estate and growing concerns regarding overbuilding in certain segments and communities.

· Backlog increased in the Middle States during the third quarter, though it was not enormous (less than 0.2 months). Moreover, the Middle States still have a significantly lower backlog than any of the four major regions.

· Backlog declined in the West, partially attributable to the wildfire that ravaged California. Despite this, regional backlog remains 2.7 months higher than at the same time one year ago. Construction activity is poised to remain elevated in Seattle; Portland, Oregon; San Jose, California; Los Angeles; Denver; Salt Lake City; Boise, Idaho; and Phoenix—suggesting that construction industry-related human capital shortfalls will continue to worsen.

Highlights by Industry

· Backlog in the commercial/institutional segment declined during the third quarter and now stands at its lowest level since the fourth quarter of 2016. Many factors are likely responsible, including higher capital costs for developers.

· Backlog decreased in the heavy industrial category but remains within one-tenth of a month of the all-time high established during the second quarter of 2018. Industrial production continues to expand in America, but uncertainty regarding future trade policy may be hampering investment in manufacturing and other industrial categories.

· Backlog in the infrastructure category fell beneath the 10-month threshold for the first time in more than three years. This is particularly surprising given the growing strength of state and local government finances in much of the nation. The decline in infrastructure-related backlog is likely temporary, and it may be that the prior surge in backlog in this category was due to Hurricane Harvey and other disasters that occurred in 2017. Given the recent spate of natural disasters and the impact of improved state and local government finances, backlog in this category is poised to snap back during the next several quarters.

Highlights by Company Size

· Large firms—those with annual revenues in excess of $100 million—saw their backlog contract by about one half of a month. Many of these firms are exposed to infrastructure, a category associated with diminished backlog during the third quarter of 2018.

· Average backlog among firms with annual revenues between $50 million and $100 million fell to 10.3 months, a decrease of more than 30 days. Still, backlog in this firm size category generally remains elevated.

· Backlog for firms with revenues between $30 million and $50 million experienced the steepest decline, falling by more than 2.3 months from the third quarter of 2017. Increased survey participation may have been a factor, but some of these firms also may have experienced a temporary reduction in backlog due to wildfires and other recent high-impact events.

· Backlog for firms with annual revenues less than $30 million fell to 8.3 months during the third quarter but remains near an all-time high. Backlog in this segment remains over half a month higher than at the same time one year ago. This is consistent with a still busy U.S. nonresidential construction sector.