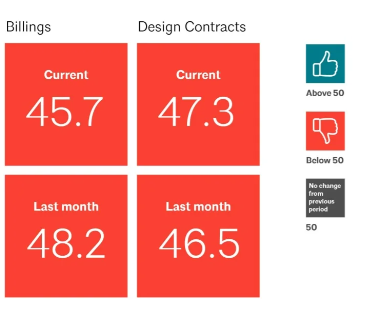

ABI August 2024: Architecture firm billings continue to decline

It has now been nearly two years since firms saw sustained growth. However, clients are still expressing interest in new projects, as inquiries into work have continued to increase during that period. However, those inquiries remain challenging to convert to actual new projects in the pipeline, as the value of newly signed design contracts declined for the fifth consecutive month in August. Business conditions softened in all regions of the country in August, with firms located in the West reporting the softest conditions for the second consecutive month. Billings were flat at firms located in the Northeast for the previous two months but dipped back into negative territory again this month. Firms of all specializations also saw declining billings in August, with conditions remaining particularly soft at firms with a multifamily residential specialization.

Hiring softens as likelihood of a decrease in interest rates increases

Conditions in the broader economy softened somewhat in August, making it all but certain that the Federal Reserve will lower interest rates at their meeting later this month. A decrease of at least .25 percentage points is a certainty, but the decrease may be as large as .50 percentage points, given softer employment numbers last month and declining inflation. Nonfarm payroll employment added just 142,000 new positions in August, well below average monthly gains of 202,000 over the previous 12 months. Construction employment was a bright spot, with a total of 34,000 new positions added, including 14,000 nonresidential specialty trade contractors. Architecture services employment declined in July, however (the most recent data available), all but erasing the gains that were made in June. Overall employment in the industry now stands at 204,900, with 3,400 fewer positions than at its post-pandemic peak one year ago. And inflation continued to ease in August, falling to its lowest level in three and a half years. The Consumer Price Index (CPI) increased by 0.2% overall from July and 2.5% over the last year. This was primarily led by declining energy prices despite modest increases in shelter and food prices.

Architecture firms are not yet fully confident that business conditions will improve by the end of the year

As the Federal Reserve prepares to lower interest rates later this month, we wanted to see if architecture firm leaders think that business conditions at their firm have reached a turning point where they should start to improve over the coming months. When asked how they think revenue at their firm for the second half of 2024 will compare to the first half, responding firm leaders were nearly equally split: 34% think that revenue will increase, 33% think that it will decrease, and 33% think that it will be about flat. Of those who think revenue will be up in the second half of the year, 7% think it will be up by 10% or more, while 27% think it will be up by 5% to 9%. Of those who think revenue will be down in the second half of the year, 13% think it will be down by 10% or more, while 20% think it will be down by 5% to 9%. Large firms with annual revenue of $5 million or more (42%), firms with an institutional specialization (39%), and firms located in the Midwest (39%) were most likely to expect billings to increase. In comparison, small firms with annual revenue of less than $250,000 (50%), firms located in the West (37%), and firms with a multifamily residential specialization (37%) were most likely to expect billings to decrease.

At firms expecting an increase in their revenue in the second half of the year, 35% indicated that funds for public projects that have already been allocated, so the projects are expected to proceed is a major factor behind the anticipated revenue increase, followed by backlogs at a comfortable level (rated as a major factor by 35% of firms) and projects that have been delayed or stalled that will be restarting (rated as a major factor by 32% of firms). Just over half of firms (51%) indicated that a slowing construction market taking pressure off of construction labor and materials prices is not expected to be a factor in the revenue increase, while 60% said that their firm being more fully staffed and able to increase billings is not a factor.

At firms expecting a decrease in their revenue in the second half of the year, more than two-thirds of firms indicated that current projects winding down, and fewer new ones on the horizon, is a major factor in that anticipated decrease, while 52% said that uncertain economic conditions that are discouraging potential clients is a major factor, and 50% cited declining backlogs as a major factor. Staffing issues are not a major contributing factor at this time; however, more than three-quarters (77%) of firms say that the lack of architectural staff necessary to increase billings is not a factor in their anticipated revenue decrease.

Finally, when asked about their degree of confidence that their firms will see improved business conditions over the next 12–18 months, three-quarters of firms were at least somewhat confident, with 14% saying that they are very confident. However, slightly more than one in five firms (21%) indicated they are not very confident, while the remaining 4% said they don’t know. Large firms, firms located in the South, and firms with a multifamily residential specialization were most likely to indicate that they are very confident that they will see improved business conditions over the next year and a half.

Join us for FREE at the next AIAU live webinar, Economic Update: Q4 2024 ABI Insights, on Thursday, November 7, 2024, at 2pm ET.