Architecture Billings Bounce Back

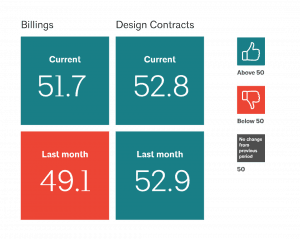

After a stand-alone month of contracting demand for design services, there was a modest uptick in the Architecture Billings Index (ABI) for October. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 51.7, up from a score of 49.1 in the previous month. This score reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.2, up from a reading of 59.0 the previous month, while the new design contracts index eased slightly from 52.9 to 52.8.

“As we enter the fourth quarter, there is enough design activity occurring that construction conditions should remain healthy  moving through 2018,” said AIA Chief Economist, Kermit Baker, Hon. AIA, Ph.D. “Extended strength in inquiries and new design contracts, along with balanced growth across the major building sectors signals further gains throughout the construction industry.”

moving through 2018,” said AIA Chief Economist, Kermit Baker, Hon. AIA, Ph.D. “Extended strength in inquiries and new design contracts, along with balanced growth across the major building sectors signals further gains throughout the construction industry.”

Key October ABI highlights:

• Regional averages: Northeast (54.0), South (50.8), West (49.8), Midwest (49.0)

• Sector index breakdown: commercial / industrial (51.2), mixed practice (50.7), multi-family residential (50.7), institutional (50.7)

• Project inquiries index: 60.2

• Design contracts index: 52.8

Regional business trends at architecture firms are becoming a bit more unbalanced. While firms in the Northeast have reported strong gains in billings in recent months, firms in the Midwest reported modest declines in September and October, and firms in the West have been hovering around the no-growth zone for the past few months. Firms in the South saw weak gains in October but generally have been reporting solid monthly progress throughout the year.

Economy remains healthy; tax reform implications still uncertain

The economy remained healthy in the third quarter, apparently largely unfazed by the recent hurricanes and wildfires. The 3 percent growth in GDP largely matched the performance of the second quarter, with the increase for the year likely to be in the 2 to 2.5 percent range. That would be well in excess of the 1.5 percent growth the economy saw in 2016. However, the third quarter gains did little to help the construction sector. Both business investment in structures, and investment in new and existing homes, were reported to have declined by over 5 percent (at an annualized rate) during the quarter.

Early fourth quarter economic indicators are looking positive. Our economy added 261,000 payroll positions on net in October, offsetting the weak performance in September that was held back by natural disasters. The economy is on track to add over two million payroll jobs this year. Given that the national unemployment rate is currently just 4.1 percent—its lowest rate since late 2000—a tight labor market continues to be a major concern for future growth.

Tax reform is emerging as the next big unknown for the economy. While the construction sector and related design activity are not currently a major focus of these proposals, certainly this large sector of the economy would be impacted by any major changes in the tax system. A reduction in the corporate tax rate of the magnitude proposed would likely increase business spending and investment, with spending on facilities likely to benefit from such a change. On the other hand, current tax reform proposals likely will reduce investment in the residential sector. A decline in the ability of homeowners to deduct mortgage interest or local property taxes would make owning a home more expensive for many households, particularly those with upper-end homes. Increasing the standard deduction also would reduce the potential benefit of these interest and property tax deductions.

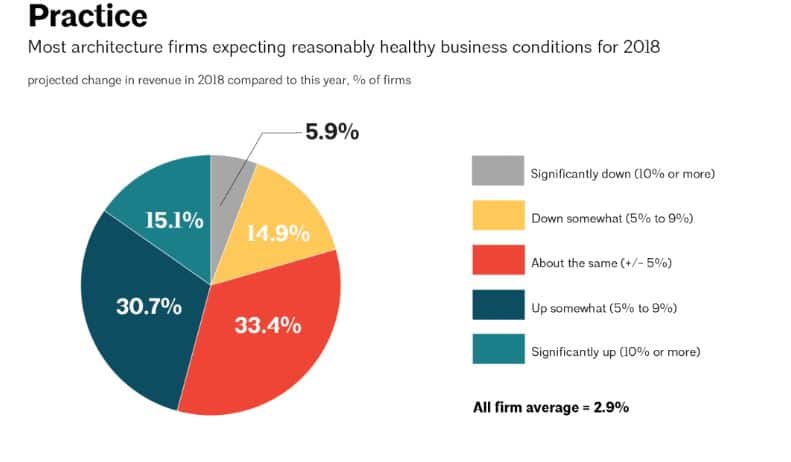

Firms expecting more growth next year; staffing is seen as a key concern

On the whole, US architecture firms are reporting solid business conditions at their firms. As the year winds down, over half of firms are projecting revenue growth of at least 5 percent for the year, while fewer than a quarter are projecting a decline of 5 percent or more from 2016 levels. Average growth across all firms is estimated to be just over 5 percent for the year. Next year is projected to produce somewhat slower growth overall but still expected to be fairly positive, with growth across all firms estimated to average just under 3 percent. Almost half of firms expect revenue to grow by at least 5 percent next year, while 21 percent are projecting a decline of at least 5 percent.

Given that almost half of firms expect fairly significant revenue growth next year, it’s not surprising that a comparable share also expect to add staff to accommodate this growth. However, those firms expecting to add staff in 2018 are generally anticipating that to be a difficult proposition. Over 40 percent of firms think that it will be extremely difficult to add qualified architectural positions in 2018, and an additional 51 percent feel that it will be somewhat difficult. Facing difficulty in adding staff is not seen to be a short-term problem. Among all firms—even those not looking to add staff in the near term—over three-quarters feel that there may be shortages of architectural staff in their area over the next few years to handle the needs of firms looking to expand.

This month, Work-on-the-Boards participants are saying:

•”Heading into the end of the year, we project steady work and multiple new project starts at a time we have historically expected work to taper off.” —23-person firm in the South, mixed specialization

•”We are seeing smaller projects than in past years, so our operational approach will have to change in order to maintain profitability.” —24-person firm in the Northeast, institutional specialization

•”The increase in contracts and inquiries is a direct response to the fire disaster in Sonoma County. Prior to that, I was going to stay small; I am now trying to hire.” —2-person firm in the West, commercial/industrial specialization

•”Business conditions are improving, with more access to capital available.” —13-person firm in the Midwest, institutional specialization