CAGC Leaders Head to the Hill to Promote Key Construction Issues, Celebrate AGC of America’s 100th Anniversary

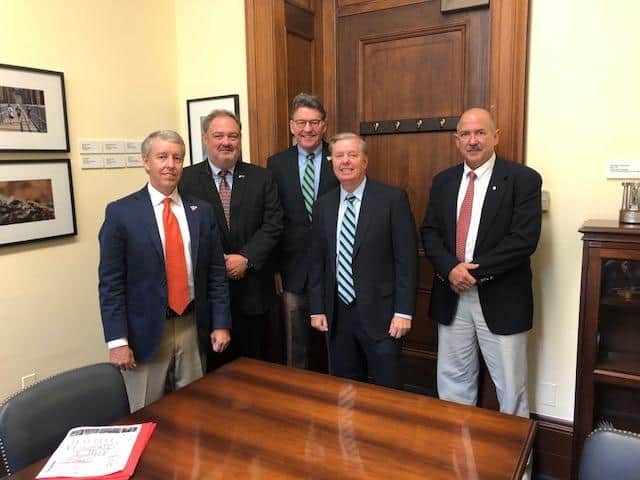

Carolinas AGC representatives this month were among dozens of AGC leaders who visited with key members of Congress – including U.S. Sen. Lindsey Graham, R-SC, and Rep. Joe Wilson, R-2nd District, SC– to promote infrastructure funding, regulatory and permanent tax reform, and an immigration climate that could help provide badly needed relief for the nation’s chronic workforce shortage. The visits were part of a three-day annual AGC of America conference attended by several hundred representatives of AGC’s 88 chapters across the nation.

“One of the biggest challenges in the construction industry today is the workforce shortage – and we made that point and it was understood,” said Paul Mashburn, chair of Carolinas AGC’s Board of Directors. “The timing was excellent to discuss what’s important to the construction industry at a time when AGC of America is celebrating this year its 100th anniversary.”

The top issues discussed by CAGC representatives with members of the Carolinas Congressional delegation and their staff included:

* Infrastructure investment: While Congress has provided new infrastructure funding, it has been inadequate to address the funding gap of $1.4 trillion over the next decade simply to maintain current investment levels in surface transportation, schools, hospitals, water/wastewater, electricity, airports and inland waterways, ports and other public facilities. A top need is to address the long-term solvency of existing federal infrastructure accounts such as the Highway Trust Fund.

* Workforce Development Plan: The federal government needs to better support adequate funding for skills-based education programs by doubling federal CTE funding over the next five years, increasing federal jobs training programs funding, and expanding the use of Pell grants for short-term credential programs. Other main components include reforming higher education to better prepare the workforce, measure student outcomes to ensure quality, enact comprehensive immigration reform to allow more people with construction skills to enter the country legally and increase apprenticeship opportunities.

* Tax Accounting Permanency: AGC’s 26,000+ member companies perform all forms of non-residential construction and consist primarily of small businesses, with more than 70% organized as S-corporations. AGC successfully lobbied for passage of the Tax Cuts and Jobs Act. While the bill improved the tax code in numerous ways, much of the tax relief and tax simplification for pass-through businesses and individuals expires at the end of 2025. This should be made permanent as well as the repeal of the estate tax and promotion of infrastructure investment in the tax code.