Construction Input Prices Down in November, Says ABC

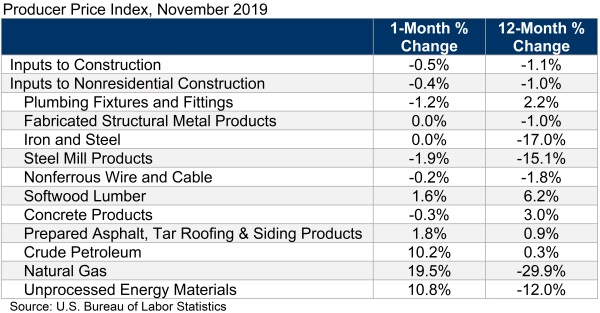

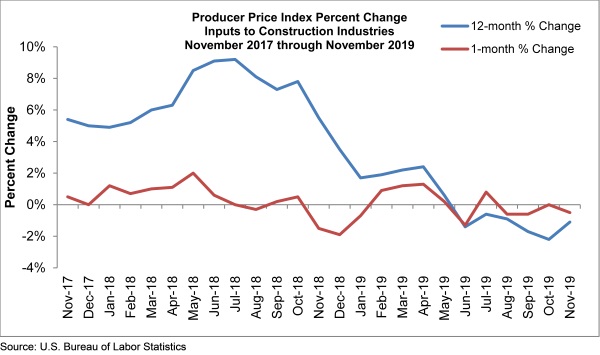

Construction input prices decreased 0.5% in November and are down 1.1% year over year, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices decreased 0.4% for the month and are down 1.0% since November 2018.

Natural gas (-29.9%) experienced the largest year-over-year decrease in prices but was up 19.5% on a monthly basis. Similarly, unprocessed energy materials prices increased 10.8% from October to November but are down 12% year over year. Two other subcategories experienced year-over-year price decreases greater than 10%: iron and steel (-17.0%) and steel mill products (-15.1%). Of the 11 subcategories considered in the PPI release, six experienced year-over-year price decreases.

“As predicted, construction materials prices largely remain a nonissue for many contractors,” said ABC Chief Economist Anirban Basu. “Certain inputs continue to rise in price, including concrete, which is up 3% for the year, but many were down on a year-over-year basis and several were down or unchanged for the month. While the concrete that is used for domestic construction is produced virtually exclusively by American enterprises, other materials are susceptible to global economic forces. With the international economy remaining soft, those commodity prices have been flat to declining.

“Even items impacted by tariffs, like steel, have fallen in price over the past year,” said Basu. “For instance, the price of steel mill products has declined 15.1% compared to the same time last year, according to today’s release.

“Given ongoing trade disputes, sluggish growth in Europe and many other parts of the world and expectations for a sturdy U.S. dollar, it is likely that downward pressure on materials prices will remain in place,” said Basu. “If that forecast proves accurate, it will help offset some of the impact of rising compensation costs in the U.S. nonresidential sector, a reflection of ongoing construction spending and a 50-year low in national unemployment. Were it not for sluggish materials prices, the cost of delivering construction services in America would be rising even an even faster rate.”