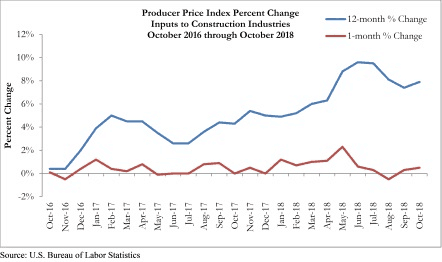

Construction Materials Prices Continue to Rise in October

Construction prices rose 0.5 percent in October and are 7.9 percent high than at the same time a year ago, according to an analysis of Bureau of Labor Statistics Producer Price Index data conducted by Associated Builders and Contractors. Prices for nonresidential construction inputs also increased 0.5 percent on a month-over-month basis and are up by more than 8 percent on a year-over-year basis.

Metals prices declined, with iron/steel prices falling 0.5 percent and steel mill prices down 0.8 percent on a monthly basis; however, prices for these categories  are 13.9 percent and 18.2 percent higher compared to last year, respectively. Crude petroleum prices continued to increase in October, rising 7.5 percent since September and 49.7 percent on a year-over-year basis. Although, oil prices have been dipping rapidly in November, which stands to be reflected in the next producer price index report.

are 13.9 percent and 18.2 percent higher compared to last year, respectively. Crude petroleum prices continued to increase in October, rising 7.5 percent since September and 49.7 percent on a year-over-year basis. Although, oil prices have been dipping rapidly in November, which stands to be reflected in the next producer price index report.

“For much of the year, construction materials prices were marching higher,” said ABC Chief Economist Anirban Basu. “However, during the late-summer, materials prices began to moderate for a number of reasons, including a slowing global economy and rising production of key inputs in response to higher prices. The expectation has been that the moderation in materials prices would only be temporary given still strong demand for construction inputs in America, which was realized in October.

“While there is anecdotal evidence suggesting that higher materials prices have stalled certain construction projects due to weaker pro-formas, for the most part demand for construction services has continued to ramp higher,” said Basu. “ABC’s Construction Backlog Indicator has recently attained record levels. The Architecture Billings Index also signals strong construction service demand going forward, especially in the southern and western United States. Public construction spending has surged over the past year due in large measure to healthier state and local government finances as well as ongoing rebuilding from last year’s storms and wildfires. Accordingly, there is little reason to expect a dip in demand for construction materials during the months ahead.

“That said, there is at least one scenario under which materials prices could fall from current levels,” said Basu. “There is evidence that the synchronized global economic expansion is becoming more uneven as nations such as Turkey and Argentina face growing headwinds. There is also evidence of economic slowing in China, though some of these reports may prove exaggerated. The recent decline in oil prices below $60/barrel does suggest, however, that the global economy is not growing as smoothly as it had been last year. Should financial markets remain volatile, there could be a general dip in asset prices globally, which would tend to suppress future commodity price and construction materials price increases. Still, the most likely outcome is for ongoing gradual increases in materials prices from quarter to quarter.”