Let’s Take a Look at the U.S. Challenging Mid-Year Economy

As we examine the approaching mid-year economy, we see the results of a perplexing mix of major economic forces. To draw an analogy, multiple large boulders are hitting the economic lake, and each one is creating waves and turbulence. The 2021 COVID-rebounding U.S. economy, lifted by past massive deficit spending and low-interest rate monetary policy, is now showing negative real growth and delivering record-breaking levels of inflation but much less in terms of personal income growth.

At the same time, the national and world economies are shocked by rising energy prices that result partly from the Russia/Ukraine war. And one more boulder to fall in the economic lake, China, the world’s second largest economy, is imposing lockdowns in major population centers in an effort to control a COVID outbreak; this adds another dose of uncertainty to U.S. export prospects as well as limiting improvements in the uneven flow of imports to U.S. ports. I should point out that on April 18, the World Bank reduced its 2022 world GDP growth estimate from 4.1 percent to 3.2 percent.[i] We can be certain that more forecasters will be making downward revisions in their 2022-2023 GDP estimates. Yet in a world with so much economic and war turmoil, we should be thankful that there are analysts who are willing to venture forth with some numerical guidance.

What Lies Ahead?

I show in the graphic below where I think the U.S. economy is headed.

As indicated and in spite of the first quarter’s negative numbers, I do not expect to see a 2022 recession marked by two consecutive quarters of negative real GDP growth. Assuming the Fed doesn’t get carried away with hitting the brakes, we will come close to recording a recession, but not quite there. I expect we will see a bit less than 2.0 percent GDP growth in 2022 and 2023.

Yes, inflation will be with us, and that means interest rates will stay elevated. Notice that I expect the 30-year mortgage rate to head above 5.0 percent but to ease a bit as the year progresses. Understandably, housing starts, which are already falling nationwide, will continue to decline. But in spite of all this, employment growth will continue to struggle forward. There are far more job openings than unemployed people right now, which will cushion the unemployment effects of a slowing economy.

What about the Carolinas?

So far, the economic turbulence of the last few quarters has not deeply disturbed the Carolina economies. Indeed, the prevailing positive migration trends into the region have been amplified by the pandemic. But as one should expect, a scan across the two states yields a mixed bag of outcomes. There are, after all, sharp in-state regional differences in signs of prosperity. But population and employment growth in the two states have been strong since the COVID-economy began, and even with the decline in exports to China, international commercial activity has been stable.

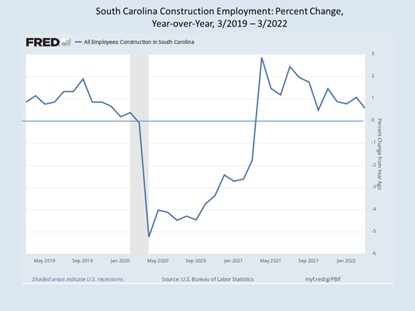

To illustrate what this means for construction, I show nearby graphs depicting recent North Carolina and South Carolina construction employment growth. Notice that year-over-year growth for March 2022 is still positive for both states, with North Carolina, the strongest of the two construction economies, showing an upward surge. I should point out that with the massive federal funding to states, civil construction activity will become the driver during the year ahead.

Final Thoughts

Since 2021, the U.S. economy has been sharply affected by a witch’s brew of COVID and a rebound from it, war, and energy shocks and multiple government efforts to counter these negative forces with massive spending and regulatory programs. We have what I refer to as a Frankenstein economy. I do not mean that we have a monster on our hands that is set to do us harm. No, I mean that we have a sutured economy with artificial parts constructed by Washington policy makers in an honest effort to make things better. By its nature, the economy is hard to comprehend and therefore difficult to forecast. This said, I conclude on a positive note: 2022 and 2023 still promise to offer positive growth prospects, but the road ahead will be bumpy.

Bruce Yandle is Alumni Distinguished Professor of Economics Emeritus, Clemson University, and Distinguished Adjunct Fellow with the Mercatus Center at George Mason University where his quarterly Economic Situation Report is posted.

[i] https://finance.yahoo.com/news/world-bank-says-war-cut-135133025.html