Looking for New Life in the National and Regional Economy

Every year April brings beautiful images of new life, but this time we are also getting positive readings on the U.S. and regional economies. With the closing of 2023, we learned that real GDP growth for the nation perked along at a 2.5% rate, well above 2022’s 1.9% and a far cry from constant calls for 2023 recessions that had plagued the financial press all year.[i] The missing slowdown had been expected for one major reason: The Fed had hit the brakes hard and on a continuing basis. Interest rates jumped, money supply growth was down, and under those conditions, a recession was expected. But along with the pain, images of a hoped for lowering of inflation to 2.0% began to be realized.

What happened to counter the effects of the Fed’s bitter medicine.

First off, unlike most of the western world, driven by record-setting immigration growth the U.S. economy enjoyed high employment gains. More people working in a tight-labor economy bring more goods and services, and higher GDP growth. But there was something else going on. The U.S. labor force was working smarter and with more capital. More workers employed working longer hours were producing more per worker than had been the case in the recent past. Assisted perhaps by Artificial Intelligence and other supply-chain improvements, labor productivity headed skyward.

Now, as 2024 progresses, we should enjoy the benefits of a healthy economy but will also be limping a bit from the effects of high interest rates on new housing starts, home sales and lending. No, we should not expect to see another 2.5% year, but we may get close. Meanwhile, the Fed has promised to end the tight money period with some interest rate cuts likely coming in 2024’s second half.

Why Slower GDP Growth?

The reason we should have less than stellar GDP growth brings us to consumer spending, which drives 70% of the nation’s economic activity. Simply put, consumers have spent the extra money that COVID relief programs put in their bank accounts. We might say things are getting back to normal. Yes, travel has recovered, restaurant sales are looking good, but major retail purchases and even grocery sales are growing at a slower pace. But while growth in consumer spending is feathering out, fed by federal infrastructure and chip production programs, spending by state and local governments is accelerating. We should see far more public sector construction, including bridges and highways, along with more industrial building. In short, the post-COVID hot-house economy, fed with federal funds and more national debt, is driving us forward. (At some point, of course, the debt chickens will come home to roost.)

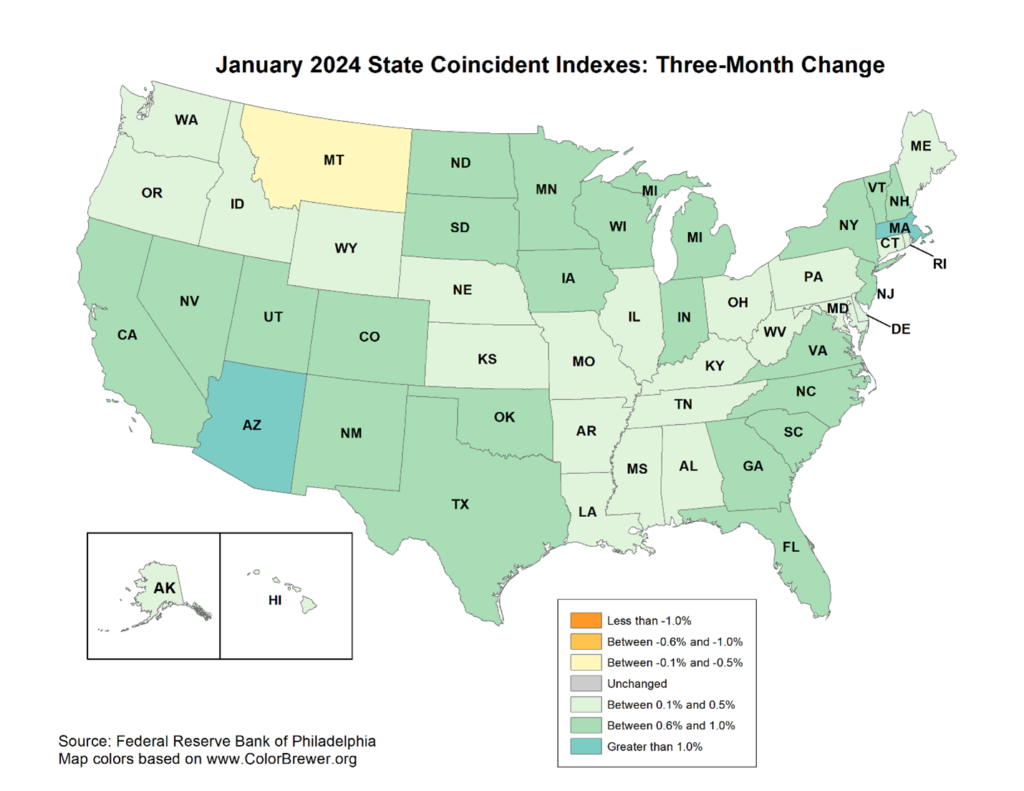

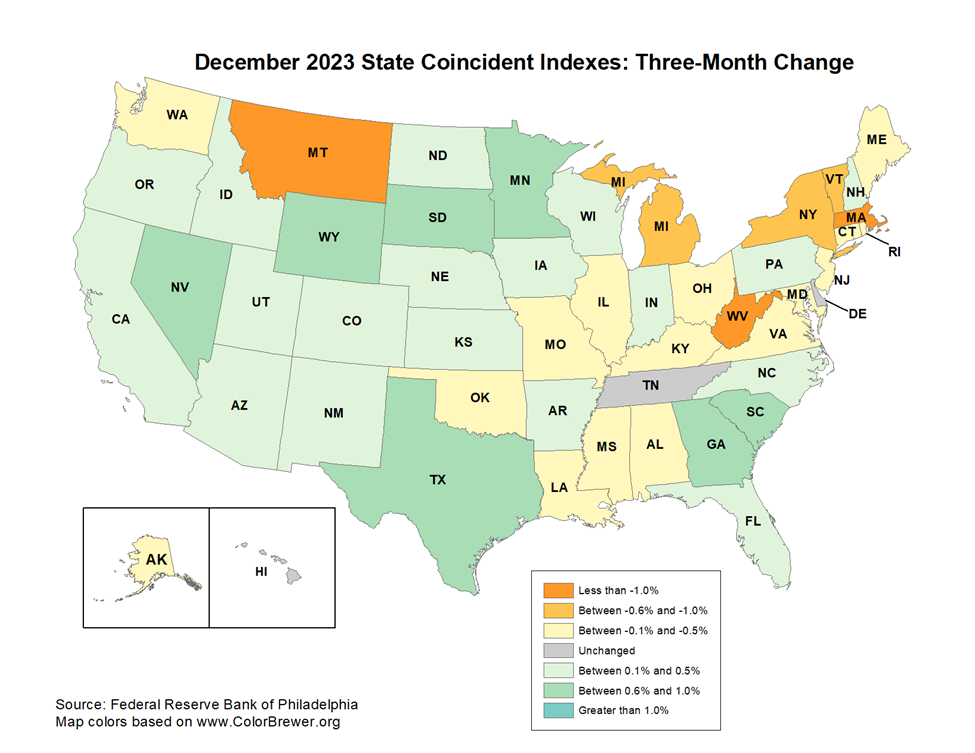

Taking a Look at the 50 States

We get a picture of how some of this looks across the 50 states by comparing two most recent State Coincident Indexes produced by the Federal Reserve Bank of Philadelphia. Here, we see a rather impressive turnaround in the nearby December and the just released January maps. Obviously, 30 days can make a big difference in the level of economic activity. The January map shows just one state—Montana—as a laggard. The South Atlantic states are stepping high.

An Explosion of New Businesses

As I survey the economic landscape, I am struck by another important optimistic indicator. U.S. new business formations continue to stand at an all-time high. Consider this, in a typical month there are more new businesses formed than new job openings announced in the U.S. economy. And each one of the new businesses has at least one person involved. In February, for example, more than 436,000 new businesses were formed in America.[ii] That same month, there were 275,000 people added to the nation’s payrolls.[iii] In North Carolina, 14,607 new businesses were formed that month, and in South Carolina, 7,715.[iv]

In short, there is an entrepreneurship revolution occurring all around us, and in most cases the results are not very visible. The new business starts are occurring in someone’s basement, kitchen, and family room. The urge to start seems to have begun with COVID when a lot of people found themselves unable to go to work and at home looking for a way to put bread on the table. Now, employers trying to find workers may be competing with the workers themselves, who have their own business opportunities. But the ongoing surge suggests small firm capitalism is alive and well.

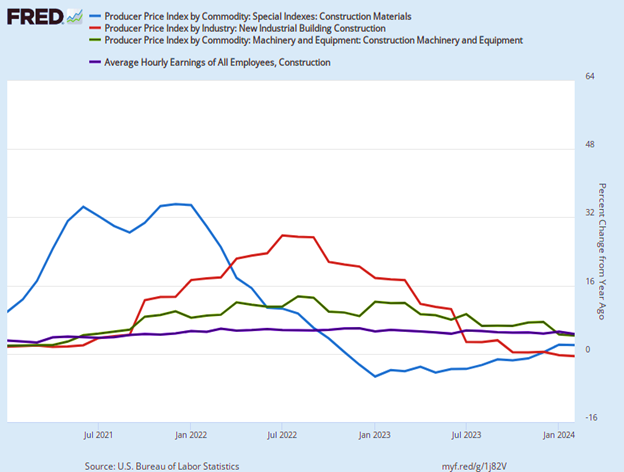

What about Construction Costs?

I noted earlier that inflation measures for the national economy have shown significant improvement and are now hitting the Fed-preferred 2.0% annual rate. In a word, considerable progress has been made in the effort to squeeze out inflation. But what about the construction sector? Has similar progress been made? Consider the next chart which shows the year-over-year increase for several construction-related price indexes along with the same measure for average construction wages. They are all based on Federal Reserve data for the national economy for the period 1/1/2021 through 2/2/2024.

A quick scan reveals first a period of rapidly rising material prices—the blue line– followed by sharp declines with some reversal showing up in the current period. At present, the materials PPI is still showing negative change. A somewhat similar but later pattern is seen for industrial building construction and construction machinery price indexes. These show year-over-year price increases growing larger until mid-July and then headed south. Finally, the index for wages hardly budges in the chart, which tells us there has been an almost constant, low level, increase across the chart period.

Final Thoughts

Spring 2024 brings new life all around us. Even the national economy is looking healthier, and the Carolinas and Southeast economies are leaders in the pack. At this point, 2024’s outlook is better than just okay, but also without indications of hard bumps or detours on the road ahead. In spite of it being crazy season when people seeking national office seem to promise anything to get elected, we Americans are enjoying the benefits of a growing labor force, improved technologies, and images of prosperity that come with the formation of new businesses.

In a word, 2024 is beginning to look pretty good. Please pass the word.

[i] https://apnews.com/article/economy-inflation-federal-reserve-gdp-unemployment-22f096fe881d4a48314c67d6f4cc67ba, https://www.bea.gov/news/2024/gross-domestic-product-fourth-quarter-and-year-2023-third-estimate-gdp-industry-and

[ii] https://www.census.gov/econ/bfs/current/index.html

[iii] https://www.bls.gov/news.release/empsit.nr0.htm

[iv] https://www.census.gov/library/visualizations/interactive/bfs-by-state.html