March Construction Starts Surge 16 Percent

New construction starts in March advanced 16% from the previous month to a seasonally adjusted annual rate of $809.2 billion, according to Dodge Data & Analytics. The substantial gain followed a lackluster performance during the first two months of 2019, as total construction starts in March were able to climb back to a level slightly above the average monthly pace during 2018.

The nonbuilding construction sector, comprised of public works and electric utilities/gas plants, jumped 40% in March from a weak February, lifted by the start of a $4.3 billion liquefied natural gas (LNG) export terminal in Cameron LA. Nonresidential building increased 24% in March, aided by groundbreaking for several large projects. These included the $1.6 billion Toyota-Mazda automotive manufacturing facility in Huntsville AL, a $1.1 billion hotel and theater redevelopment in New York NY, and the $850 million renovation of the KeyArena in Seattle WA. In contrast, residential building slipped 3% in March, as multifamily housing retreated for the second consecutive month.

During the first three months of 2019, total construction starts on an unadjusted basis were $164.5 billion, down 10% from the same period a year ago. On a twelve-month moving total basis, total construction starts for the twelve months ending March 2019 essentially matched the corresponding amount for the twelve months ending March 2018.

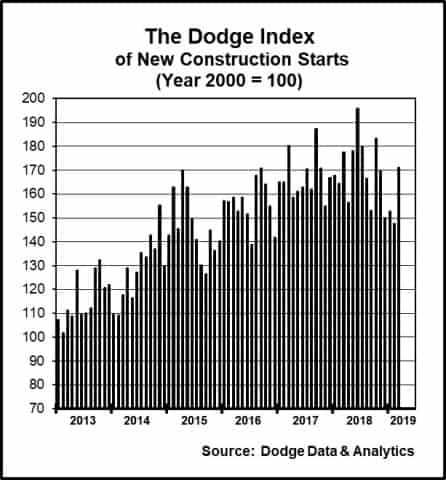

The March data produced a reading of 171 for the Dodge Index (2000=100), up from 148 in February, and 1% higher than the full year 2018 average for the Dodge Index at 170. At the same time, the Dodge Index during the first quarter of 2019 dropped 6% from the fourth quarter of 2018, as it was pulled down by the sluggish volume of construction starts during January and February.

“The month-to-month pattern for construction starts is often affected by the presence or absence of very large projects, and March certainly benefitted from groundbreaking for a number of very large projects,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “It remains true that the construction expansion is decelerating, but the March upturn indicates that the loss of momentum won’t be as pronounced as suggested by the subdued activity in January and February. It’s still expected that the overall dollar amount for construction starts for 2019 will be able to stay close to what was reported for 2018. On the plus side, the passage of federal appropriations for fiscal year 2019 in mid-February seems to be helping the public works sector. The electric utility and gas plant category has shown surprising strength during early 2019, following the steep declines over the previous three years. The commercial building segment is supported by market fundamentals that have yet to erode, while the institutional building segment continues to move at a good clip. The areas of concern in the near term relate to residential building, with single family housing not able to strengthen due to affordability constraints while multifamily housing seems to be pulling back from its strong 2018 pace.”

Nonbuilding construction in March increased 40% to $214.7 billion (annual rate), following four straight months of decline that saw activity drop a combined 19%. The electric utility and gas plant category soared 116%, led by the inclusion of the $4.3 billion Calcasieu Pass LNG export terminal project in Cameron LA as a March construction start. Gas plant-related construction starts (primarily LNG export terminals) had reached a peak back in 2015 at $26.2 billion, but then plunged to only $0.6 billion by 2017 before rebounding to $5.1 billion in 2018. The Calcasieu Pass LNG export terminal project should contribute to another increase for gas plant-related construction starts in 2019. If this massive project is excluded from the March statistics, the electric power and gas plant category would have fallen 76% from February, but gains would still have been shown by nonbuilding construction, up 7%; and total construction, up 9%. The public works categories as a group climbed 21% in March, rebounding after a 14% slide in February. Miscellaneous public works (which includes such diverse project types as site work, pipelines, and rail transit) jumped 84% after a weak February, led by such projects as a $312 million segment of the border wall in south Texas and a $283 million upgrade to a train control signal system in Brooklyn NY. Highway and bridge construction starts in March grew 4%, showing improvement after declines in January (down 5%) and February (down 6%). The top five states for highway and bridge construction starts in March, ranked by dollar volume, were – Texas, California, Pennsylvania, Florida, and North Carolina. The environmental public works categories showed a varied performance in March, with gains for dams/river harbor development, up 62%; and water supply construction, up 4%; but a decline for sewer construction, down 7%.

Nonresidential building in March advanced 24% to $303.3 billion (annual rate), as widespread growth by project type enabled this sector to reach its highest amount since last October. The manufacturing plant category jumped 108%, lifted by the start of the $1.6 billion Toyota-Mazda automotive manufacturing facility in Huntsville AL. The next two largest manufacturing plants entered as March construction starts were a $200 million rocket engine plant in Huntsville AL and a $100 million poultry processing plant in Humboldt TN. The commercial categories as a group increased 20% in March, registering the third gain in a row after very weak activity back in December. Hotel construction climbed 60%, led by the $850 million hotel portion of a $1.1 billion hotel and theater redevelopment project located in Times Square New York City. Additional large hotel projects that reached groundbreaking in March were the $233 million hotel portion of the $950 million Grand Avenue mixed-use high-rise complex in Los Angeles CA and a $187 million beach resort hotel in Oceanside CA. Office construction increased 45% in March, with seven projects valued at $100 million or more. These included two large data centers – a $750 million Facebook data center in Sandston VA and a $300 million CloudHQ data center in Ashburn VA. Also reaching the construction start stage in March were two large office projects in Atlanta GA – the $550 million Norfolk Southern headquarters building and the $314 million office portion of a $470 million mixed-use development. Store construction in March grew 11%, helped by the $150 million retail portion of the $1.1 billion hotel and theater redevelopment in Times Square. Commercial garage construction in March edged up 2%, but warehouse construction retreated 29% after its elevated February amount.

The institutional side of nonresidential building grew 17% in March, picking up the pace after basically flat activity during the previous three months. Amusement-related construction starts jumped 90%, reflecting the $850 million renovation of the KeyArena in Seattle WA that will be home to an NHL team and potentially an NBA team. The $150 million theater portion of the $1.1 billion hotel and theater redevelopment project in Times Square also lifted the amusement-related category in March. Educational facilities, the largest institutional category, grew 6% in March. Large projects that boosted the educational facility category were a $500 million research laboratory for the U.S. Department of Energy in Idaho Falls ID, a $173 million high school in Worcester MA, and a $129 million science building at San Jose State University in San Jose CA. Healthcare facilities edged up 2% in March, helped by the start of a $310 million hospital at the University of Pittsburgh Medical Center in Pittsburgh PA. The other institutional project types showed mixed behavior in March – public buildings up 48% after a weak February, religious buildings up 7%, and transportation terminals down 22%.

Residential building in March dropped 3% to $291.2 billion (annual rate), retreating for the second month in a row. Multifamily housing fell 12% in March, with the level of activity coming in 20% below the average monthly pace reported during 2018. There was one very large project entered as a March construction start – the $511 million multifamily portion of the $950 million Grand Avenue mixed-use high-rise complex in Los Angeles CA. There were five additional multifamily projects valued at $100 million or more that were entered as March construction starts, including the $165 million One Boerum Place condominium high-rise in Brooklyn NY and the $145 million multifamily portion of a $300 million mixed-use high-rise complex in West Palm Beach FL. The top five metropolitan areas ranked by the dollar amount of multifamily starts in March were – New York NY, Los Angeles CA, Miami FL, Washington DC, and Minneapolis-St. Paul MN. Single family housing in March edged up 1% from the previous month, although its March level of activity was still 7% below the average monthly pace reported during 2018. By geography, single family housing showed this pattern for March relative to February – the Northeast, up 5%; the West, up 4%; the South Central, up 3%; the South Atlantic, down 1%; and the Midwest, down 2%.

The 10% decline for total construction starts on an unadjusted basis during this year’s January-March period was due to decreased activity for all three main sectors compared to last year. Residential building fell 15% year-to-date, with single family housing down 12% and multifamily housing down 23%. Nonbuilding construction dropped 6% year-to-date, as a 23% slide for public works was partially offset by a 161% hike for electric utilities/gas plants. Nonresidential building retreated 5% year-to-date, with respective declines of 30% and 10% for manufacturing plants and institutional building while commercial building was able to register a 6% gain. By major region, total construction starts for the first three months of 2019 showed this performance versus last year – the Midwest, down 24%; the South Atlantic and the West, each down 12%; the Northeast, down 6%; and the South Central, up 2%.

Additional perspective comes from looking at twelve-month moving totals, in this case the twelve months ending March 2019 versus the twelve months ending March 2018. On this basis, total construction starts for the most recent twelve months held steady with the amount of the previous period. By major sector, nonresidential building increased 2%, with manufacturing building up 9%, commercial building up 7%, and institutional building down 3%. Residential building grew 1%, with single family housing up 1% while multifamily housing was unchanged. Nonbuilding construction dropped 4%, with public works down 5% and electric utilities/gas plants down 1%.

| March 2019 Construction Starts | |||

| Monthly Summary of Construction Starts | |||

| Prepared by Dodge Data & Analytics | |||

| Monthly Construction Starts | |||

| Seasonally Adjusted Annual Rates, in Millions of Dollars | |||

| March 2019 | February 2019 | % Change | |

| Nonresidential Building | $303,263 | $245,551 | +24 |

| Residential Building | 291,234 | 298,758 | -3 |

| Nonbuilding Construction | 214,654 | 153,437 | +40 |

| Total Construction | $809,151 | $697,746 | +16 |

| The Dodge Index | |||

| Year 2000=100, Seasonally Adjusted | |||

| March 2019…….171 | |||

| February 2019…..148 | |||

| Year-to-Date Construction Starts | |||

| Unadjusted Totals, in Millions of Dollars | |||

| 3 Mos. 2019 | 3 Mos. 2018 | % Change | |

| Nonresidential Building | $56,837 | $59,852 | -5 |

| Residential Building | 67,174 | 79,147 | -15 |

| Nonbuilding Construction | 40,508 | 43,292 | -6 |

| Total Construction | $164,519 | $182,291 | -10 |

About Dodge Data & Analytics: Dodge Data & Analytics is North America’s leading provider of analytics and software-based workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities and execute on those opportunities for enhanced business performance. Whether it’s on a local, regional or national level, Dodge makes the hidden obvious, empowering its clients to better understand their markets, uncover key relationships, size growth opportunities, and pursue those opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its 100-year-old legacy of continuous innovation to help the industry meet the building challenges of the future. To learn more, visit www.construction.com.