Monthly Construction Input Prices Rise Again in July, Says ABC

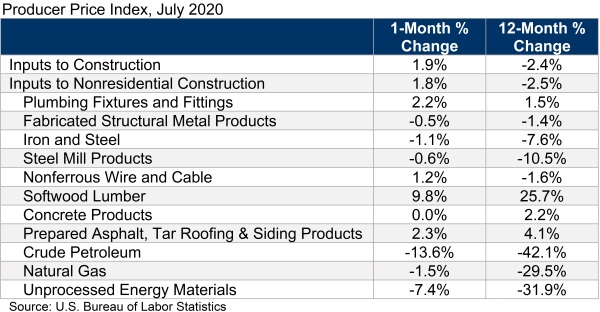

WASHINGTON, Aug. 11, 2020 — Construction input prices rose 1.9% in July over the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices rose 1.8% for the month.

Among 11 subcategories, four experienced monthly increases, with the largest price increase registered in softwood lumber, which rose 9.8% from June and 25.7% from July 2019. The largest decreases were among three energy subcategories. The price of crude petroleum experienced the largest decrease (-13.6%), followed by unprocessed energy materials (-7.4%) and natural gas (-1.5%).

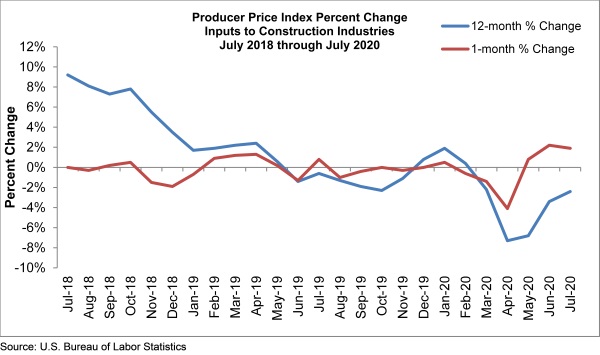

“The global and national economies have been coming back to life despite the lingering pandemic, helping to push construction materials prices higher,” said ABC Chief Economist Anirban Basu. “However, materials prices are still 2.4% lower than they were a year ago, which is largely a reflection of the massive hit to global and national economic output registered during the second quarter of 2020.

“With the pace of economic recovery softening recently, materials prices are unlikely to surge higher in the near-term,” said Basu. “Of course, there are always risks stemming from geopolitical events and/or shifting trade policy, but the macroeconomic conditions that would support sustained materials price increases are simply not in place presently.

“Even if materials prices are unlikely to surge over the short term, contractors still face risks,” said Basu. “Anecdotal information suggests that competitive bidding pressures have increased significantly in recent months, which has the effect of diminishing profit margins. ABC’s Construction Confidence Index supports this supposition, with most contractors expecting their profit margins to contract over the next six months. Correspondingly, with less room for error, unexpected increases in construction materials prices would have a more deleterious impact on contractor balance sheets than was the case pre-pandemic.”