NAOIP Releases the Fall 2024 CRE Sentiment Index

KEY FINDINGS

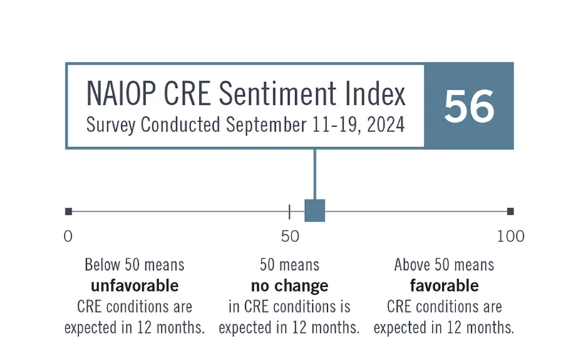

The NAIOP CRE Sentiment Index for September 2024 is 56, an increase from the April 2024 reading, indicating that respondents expect conditions for commercial real estate to improve over the next 12 months (see Figure 1).

Respondents have a positive outlook for every component that comprises the Index except for construction labor costs, which they expect to be higher next year.

Respondents continue to grow more optimistic about capital market conditions. Among the development conditions that comprise the Index, respondents expect the largest improvement over the next 12 months to occur in the availability of equity and debt, two factors that were already trending upward in the April survey.

Respondents also expect rising demand and valuations for commercial real estate. They have a positive outlook for occupancy rates, face rents and effective rents, and expect first-year cap rates to decline. Scores improved for each of these measures except face rents, which remained unchanged from April.

Expectations of declining interest rates are likely behind much of the improvement in the Index. In response to a question that is not used to calculate the Index, developers and building owners indicated they expect favorable interest rates in the next 12 months. Many open-ended comments suggest that lower interest rates will buttress building owners’ financial standing and boost transaction volume over the next year.

Greater optimism about market conditions is leading developers and building owners to project that their own deal volume will grow over the next year. These respondents had already been expecting to increase transaction volumes modestly in April (registering a score of 52) and now project a more significant increase in transactions over the next 12 months (score of 58).

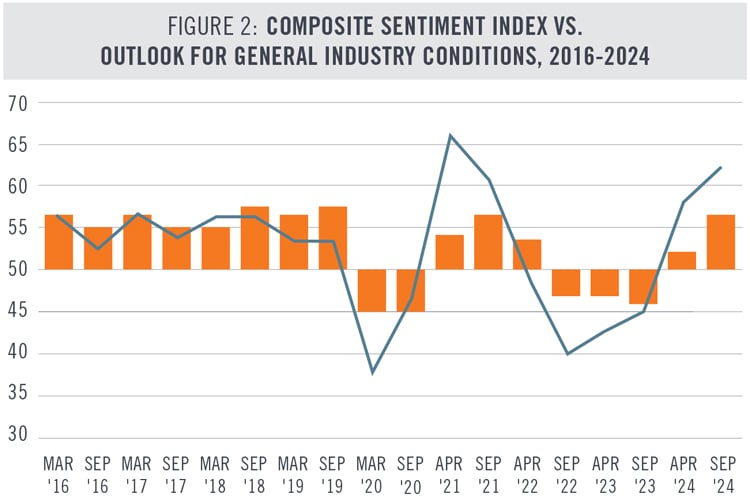

Respondents expect general industry conditions to improve significantly over the next 12 months. The score for general industry conditions (62) is calculated separately from the CRE Sentiment Index. Like the Index, it has improved since April. A higher score than the Index maybe attributable to an improved outlook for the economy overall. When asked separately from the questions that comprise the Index, developers and building owners indicated they expect favorable local economic conditions over the next 12 months.

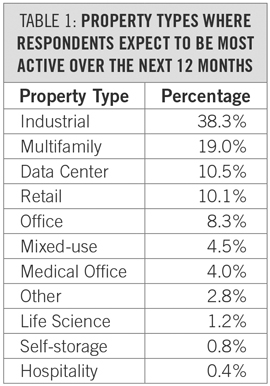

Most respondents expect to be most active in either industrial or multifamily real estate during the next 12 months (see Table 1). Data centers and retail properties attract the next highest levels of interest, and more respondents indicated they plan to be primarily active in these sectors than was the case in April.

Notable Changes in the September 2024 Survey

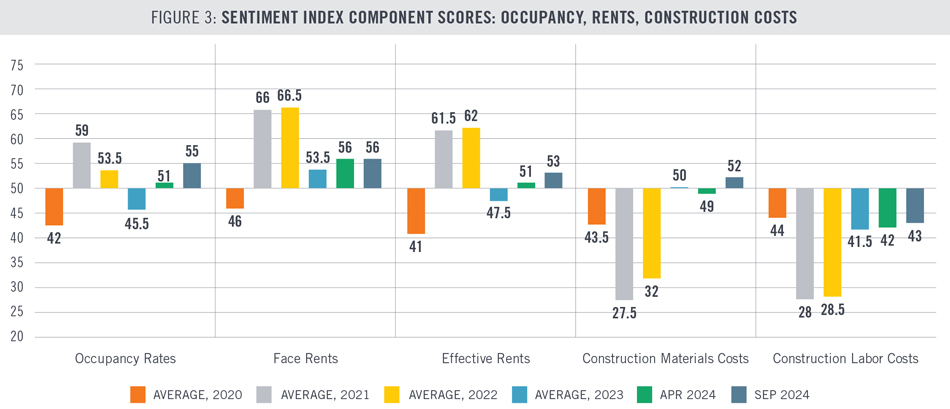

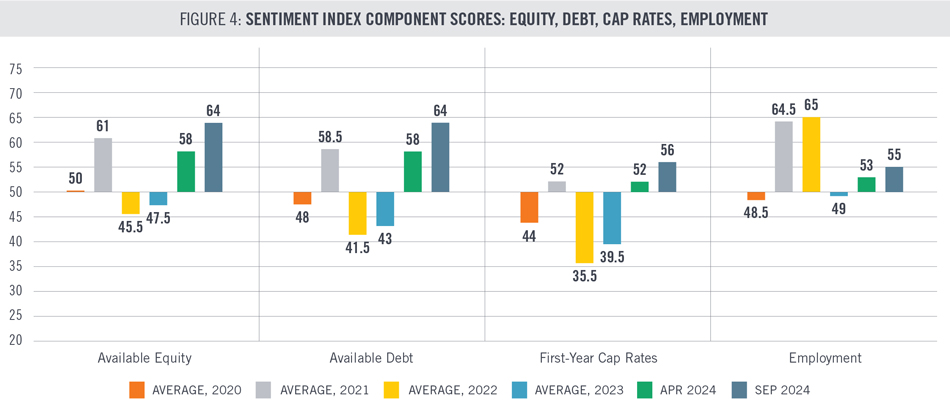

Figures 3 and 4 compare respondent expectations in September 2024 for the individual components that comprise the NAIOP CRE Sentiment Index to expectations in past surveys. For component scores from before 2020, please refer to past editions of this report. Values above 50 represent expectations that a condition will be more favorable for development over the next 12 months (e.g., higher face rents, lower construction labor costs, lower cap rates). Values below 50 represent expectations that a condition will be less favorable during the next 12 months.

Indicators for debt and equity markets rose more sharply than the outlook for other CRE fundamentals. Compared with the April survey, the outlook for debt availability and equity availability tied for the largest improvement, each with a score of 64, followed by first-year cap rates (56) and occupancy rates (55). All four indicators were also on an upward trajectory in April. Improving expectations related to debt and equity markets are likely driven by a consensus that interest rates will decline. It should be noted that only eight of the 496 respondents to take the survey did so after the Federal Reserve announced a 50-basis-point rate cut on Sept. 18.

Other changes were more modest but also suggest improving conditions for development. Respondents project a somewhat greater improvement in effective rents and now expect construction material costs to decline slightly. They also expect a larger increase in employment at their own firms than was the case in April. They continue to expect construction labor to be more expensive over the next 12 months. Open-ended comments suggested that they remain more pessimistic about the office sector than other property types. The outlook for other types of commercial real estate depended on conditions in specific geographic markets.

Several respondents expressed concern or uncertainty about the upcoming election. In open-ended comments, some respondents suggested that conditions for commercial real estate would be dependent on the outcome of the upcoming presidential and congressional elections.

Expectations for Development Conditions

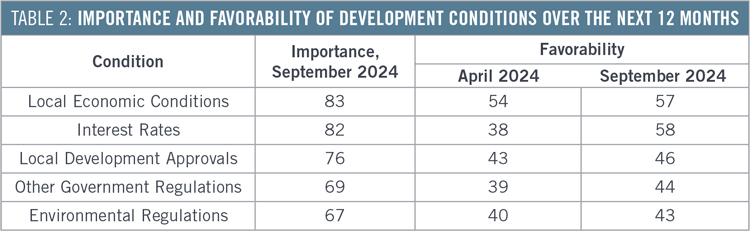

The survey asks developers and building owners to evaluate how important interest rates, local economic conditions, local development approvals processes, environmental regulations and other government regulations will be to their decisions to initiate or continue development projects over the next 12 months (answers are not factored into the NAIOP CRE Sentiment Index). The survey then asks developers how favorable they expect these conditions to be. The results are described in Table 2 on a 100-point scale.

Respondents now rate local economic conditions as the most important factor in their development decisions, closely followed by interest rates. They expect interest rates to be sharply more favorable over the next 12 months than they did in April and for local economic conditions to be somewhat more favorable. Their outlook for local development approvals, environmental regulations and other government regulations has improved modestly since April, though respondents expect each factor to remain unfavorable for development. This shift in the regulatory outlook may be due to a variety of factors, such as movement in the markets in which respondents are active, a change in the way political leaders are framing commercial real estate development or an expectation that the results of the upcoming election will lead to lighter regulation.

Differences Between Developers and Non-developers

Respondents were asked to identify their primary profession. When comparing the responses of developers and building owners to non-developers, two statistically significant differences related to the conditions that comprise the Sentiment Index emerged (see Table 3). Non-developers indicated a higher likelihood that their firms would expand employment over the next 12 months than developers and building owners. Non-developers also expect first-year cap rates to decline more significantly than developers and building owners. Both metrics suggest a more conservative outlook among developers and owners than other CRE professionals, but it is also possible that some of the apparent difference could be attributed to variations in the geographic markets and property types in which the two groups are most active. Another possible explanation is that employment in non-developer firms is less sensitive to interest rates and construction costs, which remain relatively high despite increased optimism about the coming year.