Office Leasing Activity Expected to Grow Amid Sustained U.S. Economic Strength

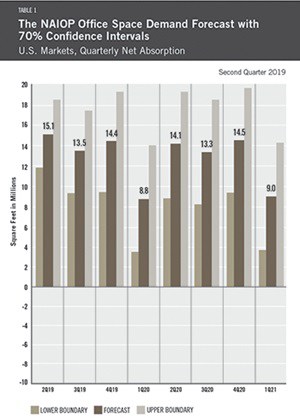

The U.S. office market continues to expand ahead of forecast, posting

18 million square feet of net absorption in the fourth quarter of 2018

and 11 million square feet in the first quarter of 2019, says the NAIOP Office Space Demand Forecast. Continued economic growth and increases in job creation are likely the main forces behind these levels of new leasing.

With first-quarter U.S. GDP growth of 3.2% annualized and a current

unemployment rate of 3.6%, U.S. office space demand should remain strong

during 2019. Report authors Dr. Harry Guirguis, Manhattan College, and

Dr. Joshua Harris, New York University, expect demand to register an

average of 13.5 million square feet of net absorption per quarter, which

will moderate slightly to an average of 12.7 million square feet per

quarter in 2020.

This forecast is driven by continued expected strength in

office-using employment, which has grown twice as fast as general

employment. According to the U.S. Department of Labor’s March 2019 jobs

report, the primary office-using sector, Professional and Business

Services, grew 1.22% year-over-year compared to just 0.6% for total

nonfarm employment.

The continued strength in the office demand forecast for 2019 also

likely represents a partial reversal of the recent trend in decreasing

square footage per employee. The faster pace of leasing in 2018 through

the first quarter of 2019 appears to be a response to high rates of

office-using employment growth in 2016 and 2017. Due to job creation and

sustained office-leasing activity, some tenants may have reached the

limits of their office footprint reductions. As firms grow in response

to economic opportunity, they may feel pressure to add more space per

employee. However, newer coworking concepts such as WeWork are just

beginning to expand into smaller markets. Therefore, the potential

exists for unpredictable future disruptions.

While the possibility of a late 2019 or early 2020 economic slowdown

seemed plausible at the end of last year, current economic data suggests

that the next downturn is more likely to occur in 2021. Overall job

creation, unemployment, consumer confidence and interest rates all

support the continued economic growth experienced for the past several

years. The authors expect U.S. GDP growth and job creation to moderate

by the end of 2019 and during 2020, which means the forecasted rate of

net office absorption is expected to be lower in 2020 than 2019.

Office Space Demand Forecast 2Q19 Accompanying charts and graphics, as well as opportunities for interview, are available.