Q3 2019 USG + U.S. Chamber of Commerce Commercial Construction Index

The Q3 2019 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index (Index) released today climbed to a record high score of 77, up from 74 in Q2 2019. Half of all contractors expect revenue increases over the next year, rising 14 points quarter-overquarter. Also, notably higher is the expectation for profit margins to increase in the next year, which grew by 12 points between Q2 and Q3 2019.

The majority (58%) of contractors report they are highly confident that the next 12 months will bring sufficient business opportunities, a six-point growth over Q2. This is the largest percentage in the last four quarters to report this degree of optimism.

“Contractors are thinking about the future and are optimistic about what’s ahead,” said Christopher Griffin, CEO of USG Corporation. “Continued levels of confidence around backlog and profit suggest nonresidential construction will continue to play an important role in overall sector growth.”

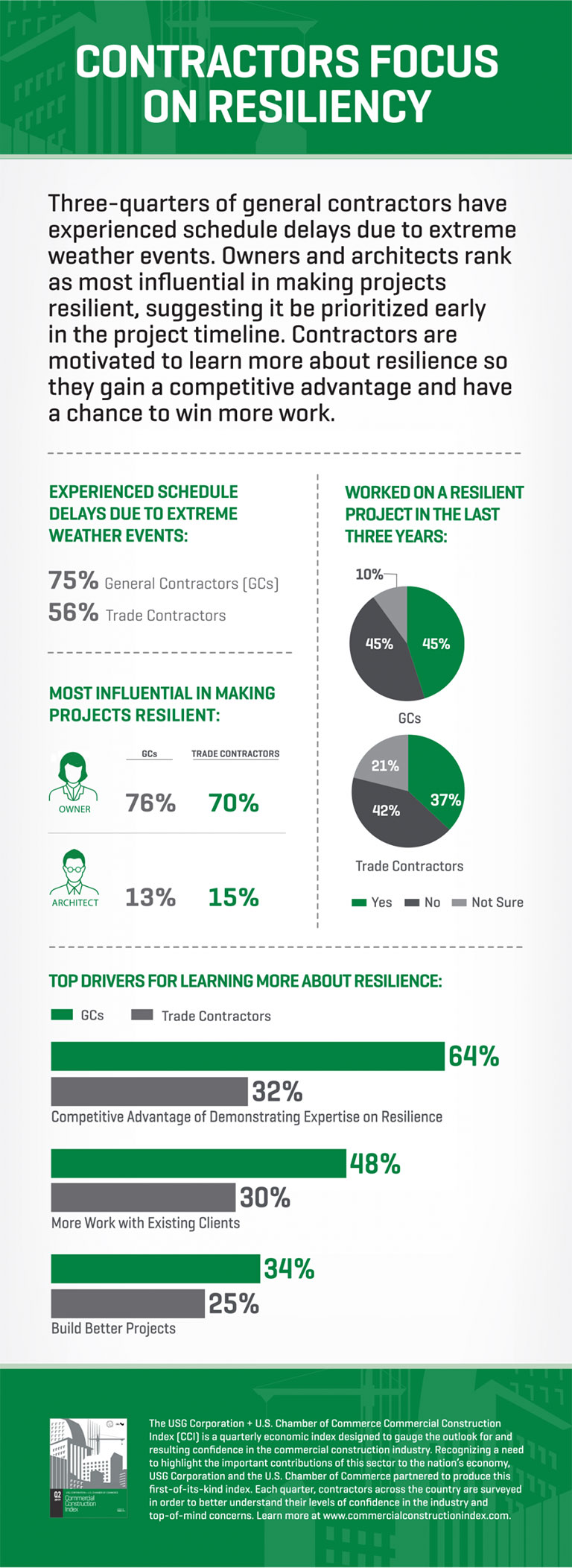

In Q3, the Index survey also asked contractors about resiliency: a timely topic as the South Atlantic reels from Hurricane Dorian and braces itself for the impacts of the 2019 hurricane season. Not surprisingly, three-quarters of general contractors said they have experienced schedule delays due to extreme weather events. Yet, only 38% of respondents in the South said they include the impact of weather when calculating project bids. About two-thirds of contractors agree that building codes on resiliency are necessary to improve the ability of buildings to withstand the impact of severe weather and natural disasters but find the current codes only moderately effective. Contractors agree that resiliency efforts need to be prioritized earlier in the project, with more than 70% ranking owners as the most influential in making projects resilient. Nearly all contractors report having seen architects/engineers design with resiliency in mind in the last three years. However, this is not viewed as common practice as less than one-third claim to have seen it happen on 25% or more of all projects.

“Half of contractors report turning down jobs because of a lack of workers,” said Neil Bradley, U.S. Chamber of Commerce executive vice president and Chief Policy Officer. “We have the opportunity to expand the number of people with good paying jobs and keep our economy growing, but only if Washington steps up to fix our broken immigration system and reform employment training programs.”

Consistent with the last several quarters, contractors report that they expect to increase their workforce, with 61% having plans to hire in the next six months. However, respondents report continued challenges in finding skilled workers with the majority (61%) reporting difficulty, up 4% yearover-year and up 7% quarter-over-quarter. To deal with skilled labor shortages, 81% of contractors ask their current skilled workforce to do more work, while 49% currently turn down opportunities for work due to shortages. The Index comprises three leading indicators to gauge confidence in the commercial construction industry, generating a composite index on the scale of 0 to 100 that serves as an indicator of health of the contractor segment on a quarterly basis.

The Q3 2019 results from the three key drivers were:

Backlog: The backlog indicator remained at the high of 82 (the same as in Q2).

New Business Confidence: The overall level of contractor confidence moved upward to 76 (up two points from Q2).

Revenue: Contractors’ revenue expectations over the next 12 months bounded to 72 in Q3 (up six points from Q2).

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights.

The Commercial Construction Index (CCI) is a quarterly economic indicator designed to gauge what drives the commercial construction industry and its leaders, based on research conducted with contractors. Topics covered include the three factors from which the Index is derived—backlog levels, new business opportunities and revenue forecasts—and additional market drivers such as workforce, financing, and materials and equipment trends. The Index also features a quarterly spotlight on revolving construction industry topics.

- The Q3 CCI is 77, an increase of three points from the Q2 index number

- Expected increases in spending on tools and equipment and consistent access to financing for the industry

- The quarterly spotlight looks at two aspects of resiliency for contractors in particular: the strategies for making their own businesses more resilient and their perception of efforts to make buildings more resilient

Watch a webinar on this report here.