Resurgence in Office Leasing: Breakout Economic Growth Forecasts Higher Rates of Net Absorption

The U.S. office market posted solid net absorption levels in the second and third quarters of 2018 of 18.0 million and 11.0 million square feet, respectively. This level of new leasing is likely due to higher-than-expected economic growth and the subsequent demand brought about by jobs created in the office-using sectors. This increase in demand is a factor in the increase in office construction activity in North Carolina and South Carolina.

Download the NAIOP Office Space Demand Forecast, Fourth Quarter 2018

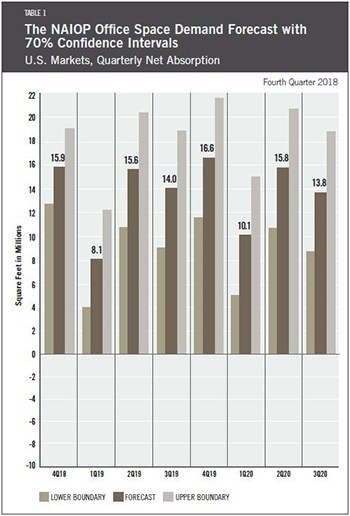

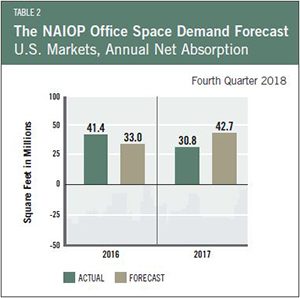

Due to third quarter 2018 U.S. GDP growth of 3.5 percent and a current unemployment rate of 3.7 percent, 2018 is expected to register nearly 13.0 million square feet of net absorption per quarter, significantly outpacing 2017 and 2016 when the quarterly figures averaged 9.5 million and 10.4 million square feet, respectively. The forecast is strongly dependent on continued annual economic growth near 3.0 percent, which seems plausible for all of 2019 and into 2020 given current data.

Several economic indicators show the strength of the U.S. economy, including the U.S. Census Bureau Advance Monthly Sales for Retail and Food Services report, the U.S. Census Bureau Durable Goods report and the growth in private non-residential fixed investment as measured by the U.S. Bureau of Economic Analysis. The current macroeconomic expansion will most likely continue beyond next summer, which will officially make it the longest sustained economic growth period in U.S. history.

However, the biggest limitation to the expansion of firms that use office space is likely to be the ability to hire qualified employees. According to the Bureau of Labor Statistics, new job openings are now growing at an annualized rate of 4.6 percent, up from 3.6 percent a year ago; total job openings reached an all-time high of 7.1 million, up from just over 6.0 million a year ago. The total number of job openings exceeded the total number of unemployed persons earlier this year for the first time in the history of collecting such data in the U.S. Thus, the authors predict that firms will face expansion challenges despite rising market demands in 2019.

Due to the labor shortage, wage growth will contribute to overall inflation and interest rates will likely continue to increase, with rising interest rates moderating economic activity over the next two years. Regarding office space demand, the ultimate determinant of long-term growth will be how the business sector reacts to rising wages and interest rates. Federal Reserve Board projections of GDP suggest that current levels of economic growth will be sustained as firms bow to competitive pressures and expand. The most plausible event to disrupt this scenario would be worsening geopolitical instability.