The 2023 Economy: Taking a Look at the World, the Nation, and the Carolinas

With 2023’s first month behind us and more 2022 data in hand, this is a good time to look closer at the year just ended and consider images now forming for the year ahead. An assessment of the world situation by the global consultancy PwC presented a few weeks ago at the Davos World Economic Forum is a good place to start.[1] PwC’s survey of more than 4,000 CEOs from 105 countries found that 73 percent expected global GDP growth to fall in 2023. Even more challenging, perhaps, 40 percent of the CEOs indicated their firms would not be in business 10 years from now unless they made major changes in how they do business. From this perspective, the outlook is certainly nothing to cheer about. The world is being rewired.

Recent U.S. real GDP forecasts for the year ahead generally parallel what was reported in the PwC survey. For example, the latest Wall Street Journal panel of economists indicate less than one percent real growth across each of this year’s four quarters.[2] The Philadelphia Fed’s forecast shows less than one percent growth in 2023’s first three quarters but with rising growth in the last quarter. And Wells Fargo economists are calling for practically no growth in this year’s first half and for solid negative growth in the second half. Based on Fed action to reduce the money supply and the lag between those reductions and GDP growth, I lean toward the Wells Fargo estimate. This says weak but positive GDP growth in 2023’s first half and negative growth in the last six months. Of course, there are other major events that can occur along the way to change the path we are on, but this is my current view of the situation.

In some ways, it’s difficult to square these rather pessimistic forecasts with Department of Commerce data just received for 2022 fourth quarter GDP growth. As the year was ending, real GDP growth was moving at 2.9 percent, weaker than second quarter’s 3.2 percent, but still at a good pace. Retail sales, still supported from the remains of stimulus funding, was a source of strength as well as inventory buildups in the energy sector.[3] Hard hit by rising interest rates, fourth quarter housing activity continued to weaken, however, later data on December retail sales and industrial production tell us things are slowing in those sectors.

What about the Carolinas?

A slowing world and national economy will obviously bring slower economic activity in the two Carolinas. But the two economies will be operating from a position of considerable strength. Located in one of the strongest U.S. regions —the Southeast, the Carolinas rank high on recent population and employment growth. In 2022, with a population growth of 1.7 percent, South Carolina was the nation’s third fastest growing state. Florida led the pack with 1.9 percent growth. Idaho, with a growth of 1.8 percent, ranked second. North Carolina ranked ninth with 1.3% growth. Along these lines, close observers of highway traffic may have noticed the large number of U-Haul trailers headed in our direction. In 2022, South Carolina ranked third in the nation for one-way U-Haul destinations. North Carolina was number four. Texas was the top U-Haul state followed by Florida.

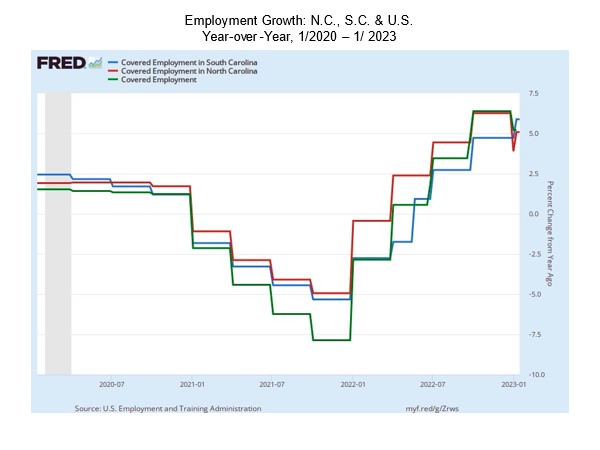

Of course, strong employment growth is a major population magnet, and the two Carolinas have performed well in recent years. Consider the next chart that shows year-over-year employment growth for the Carolinas and the United States for the period 1/2020 to 1/2023. Both Carolinas outperformed the nation during the 2021 slowdown. As North Carolina’s red line shows us, employment growth there outpaced South Carolina’s and U.S. growth from 2022 to the present. South Carolina employment growth was about the same as the nation’s from 2022 forward. The two Carolinas enter 2023 with a strong employment growth record.

Taking a Look at the Counties

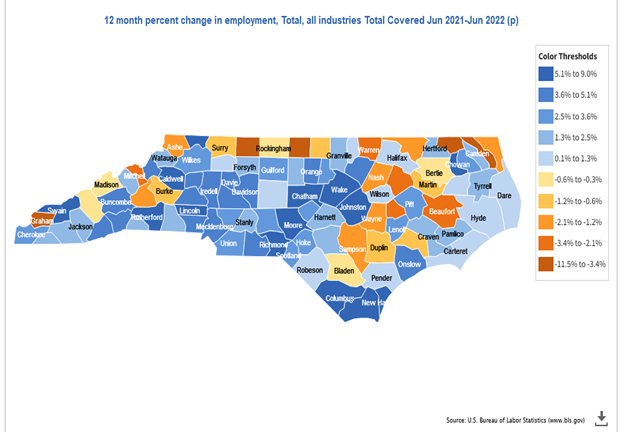

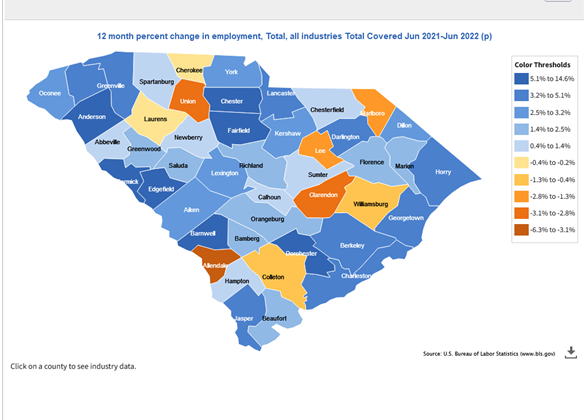

Going beyond the overall state numbers, a quick look at county employment growth using Bureau of Labor Statistics data tells us where in each state economic activity has been strongest. Consider the two county outline maps that follow. These show employment growth for the period June 2021 through June 2022. The darker blue counties have the higher growth; the tan counties lost employment. As indicated, blue counties are wide spread across both states, and high growth tends to be close to the major interstate highways in each state.

Final Thoughts

The last two years have been challenging, to say the least. We have experienced a rocky pandemic recovery, tough efforts by the Fed to bring down inflation that are still ongoing, and a Russia/Ukraine war that has disrupted energy and food markets worldwide while killing thousands and destroying massive amounts of homes, structures, and capital. These disruptions together are causing the world economy to be rewired and the U.S. and regional economies to adjust. As we look ahead, the prospects are not all that cheering. That said, the two Carolinas are strongly positioned to roll with the economic punches and to avoid the worst part of the slowing world economy.

Bruce Yandle is Alumni Distinguished Professor of Economics Emeritus, Clemson University, and Distinguished Adjunct Fellow with the Mercatus Center at George Mason University where his quarterly Economic Situation Report is posted.

[1] https://finance.yahoo.com/news/davos-pw-c-survey-finds-bleak-ceo-outlook-for-2023-174505340.html

[2] https://www.wsj.com/articles/despite-easing-price-pressures-economists-in-wsj-survey-still-see-recession-this-year-11673723571, https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q4-2022 https://wellsfargo.bluematrix.com/docs/html/91b6ac66-9549-488e-b899-03e251382274.html.

[3] https://www.bea.gov/news/2023/gross-domestic-product-fourth-quarter-and-year-2022-advance-estimate.