The 2023 Year-End Economy and the Road Ahead

With horrible wars underway in the Middle East and Ukraine, a strong dose of compartmentalization is required to focus attention on the prospects for the economy. But if we are to make a difference to those in devastated places, it will be necessary for us to make the best of our own situation, to try to do something about construction instead of destruction, and, in a sense, try to have an influence on things we may affect. With this in mind, let’s put on our economics glasses and take a look at our more immediate world.

When the first estimate for nation’s 2023 third quarter GDP growth soared at an annual rate of 4.9 percent, we knew we had avoided a recession.[1] There was also recognition that an unusual inventory run-up contributed to the surge. But now we have a situation where most of the pandemic stimulus money is spent[2], retail sales and employment growth are weakening[3], and bass boat sales are in a state of decline. If we sprinkle into the mix an election year and uncertainty due to a reshuffling of world powers, we get more than just a cloudy situation. Both economic data and common sense tell us 2024 will likely see slower growth in real GDP and construction.[4]

Looking further, a scan of state data confirms that things are slowing a bit. Even though prospects for negative real GDP growth have been pushed forward into 2024 by some forecasters, we must remember that the tough action taken by the Fed to purge inflation from the economy affects activity with a lag of more than 12 months. Put another way, a slowdown, but not necessarily a recession, is already baking in the oven.

Let’s take a closer look at how the nation is doing. Then, we will tighten our focus on state activity and the Carolinas.

How’s the Nation Doing?

Considered at the macro level, the 2023 U.S. economy has performed better than many expected. As shown in the accompanying table, growth is up and inflation, down. Things look good on the employment front as well. The unemployment rate moved up slightly from first quarter’s 3.5 percent to third quarter’s 3.7 percent.[5] However, with things slowing due to the bite of higher interest rates, the unemployment rate for October rose to 3.9 percent.[6]

Key Economic Data Points

|

|

4Q 2022 |

1Q 2023 |

2Q 2023 |

3Q 2023 |

|

GDP Growth |

2.65% |

2.20% |

2.10% |

4.90% |

|

CPI |

7.11 |

5.76 |

4.05 |

3.56 |

|

Unemp |

3.60 |

3.50 |

3.60 |

3.70 |

|

10-Year Bond |

3.83 |

3.65 |

3.60 |

4.15 |

Source: Federal Reserve Bank of St. Louis. Federal Reserve Economic Data.

There are rather wide-ranging GDP forecasts for the year ahead. For example, Wells Fargo’s mid-November forecast calls for a mid-2024 recession, with slightly less than one percent growth for the year.[7] Goldman-Sachs, on the other hand, is not predicting a 2024 recession and is expecting 2.1 percent growth for the year,[8] and the U.S. Congressional Budget Office, much like Wells Fargo, is calling for 1.0 percent growth in real GDP for 2024.[9] Finally, the Federal Reserve Bank of Philadelphia’s November survey of professional forecaster’s indicates 1.7 percent GDP growth for 2024, without a mid-year recession.[10] As for me, based on 2023 negative growth in the money supply, I expect to see a weaker 2024 economy and near-zero or negative real GDP growth in 2024’s second half.

How Have the States Fared?

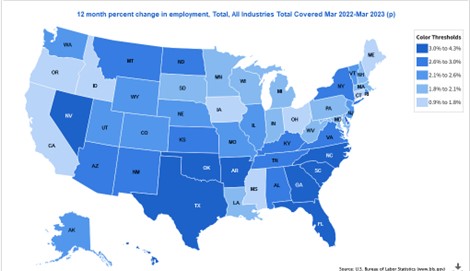

The latest Bureau of Labor Statistics survey data on state employment growth from March 2022 through March 2023 reveals relative strength across the 50 states. As seen in the nearby chart, there are eight states registering less than 1.8 percent growth. The map shows noteworthy srength for the southeast and for Texas, Oklahoma and Arkansas.

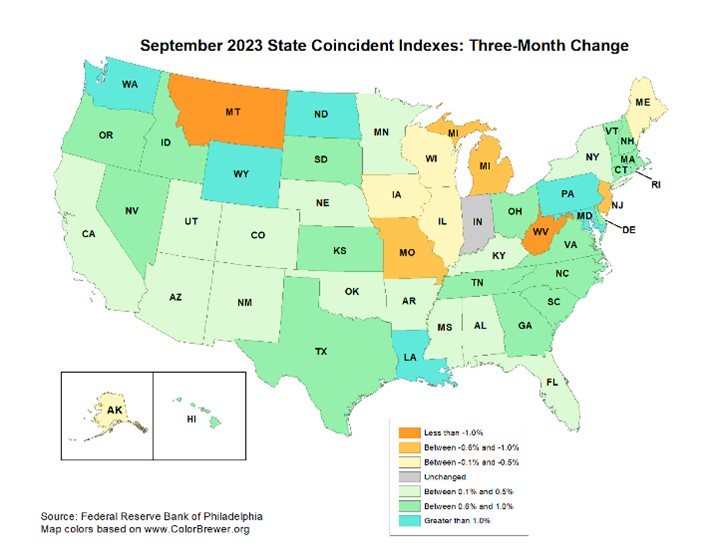

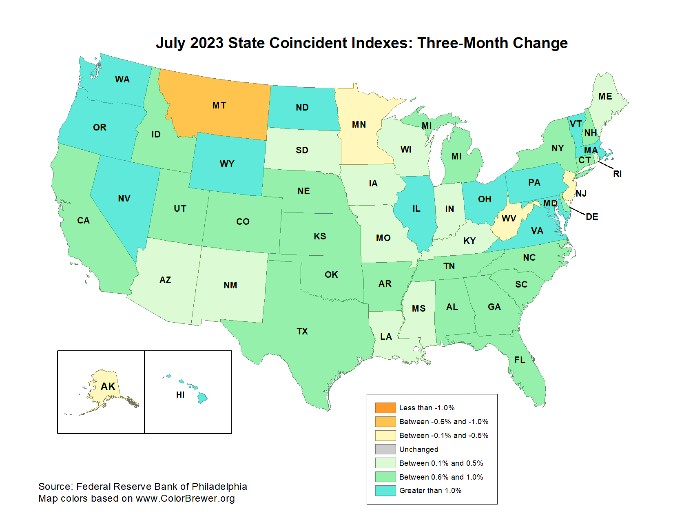

A closer look at state economic indicators for July and September adds a bit more information about what is happening across the vast U.S. economy. The two accompanying maps prepared by the Federal Reserve Bank of Philadelphia show the three-month change in coincident indicators, which is an estimate of how things are doing now, not in the future. A comparison of the two maps reveals a slowing economy. There are more light-yellow and mustard-colored slow-growth states in September than in July, while the stronger Atlantic seaboard states and Texas continue moving apace.

Looking Closer at the Carolinas

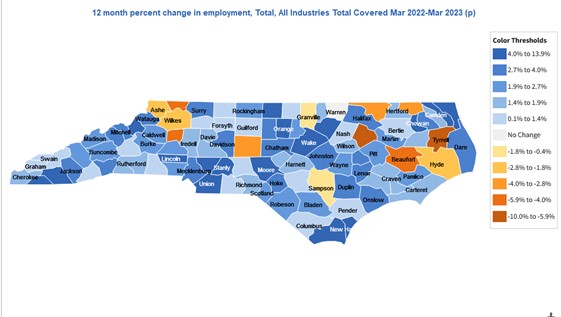

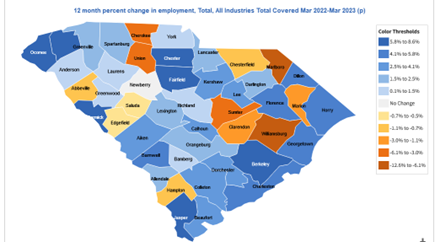

Giving a closer look at the two Carolinas, the next two maps show county employment growth for the March 2022-March 2023 year. The relative strength of North Carolina’s western region including a sweep that includes the Charlotte metro area is noteworthy. Typically, county employment growth is highest along the state’s interstate arteries. South Carolina’s employment growth has been strongest along the coast with relative strength higher in the I-85 corridor.

Final Thoughts

As we approach the year-end, we can conclude that the 2023 economy performed better than most forecasters expected. Part of the strong performance was driven by the resilience of the U.S. market economy, surging small businesses, and recovery from pandemic shutdowns. Yet another part of 2023’s strength came from expanding federal spending activities intended to stimulate production of electric vehicles and to rebuild America’s infrastructure.

Funded with borrowed money, the expanded federal presence brings a large increase in the interest cost of the debt. This brings increased political challenges as congress grapples with a tightening budget. Finally, we should note that our growing deficits mean that we are consuming more than we produce. It is all the more important that we maintain an open door for imported goods from dependable trading partners who welcome opportunities for gains from trade.

[1] https://www.bea.gov/data/gdp/gross-domestic-product

[3] https://www.bls.gov/news.release/empsit.nr0.html, https://www.census.gov/retail/sales.html.

[5] https://fred.stlouisfed.org/series/UNRATE

[6] https://www.bls.gov/news.release/pdf/empsit.pdf

[7] https://wellsfargo.bluematrix.com/links2/html/63cd219b-4576-4381-a985-38e0318d3352

[9] https://www.cbo.gov/data/budget-economic-data#4

[10] https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q4-2023