The Carolinas’ 2025 Deal Book: Foreign Investment, Growth, and Policy Crosswinds

The first eight months of 2025 have confirmed what many executives and contractors in the Carolinas already sense: the region remains a magnet for capital investment, even as national indicators turn mixed. From hyperscale data centers and advanced life sciences plants to aerospace assembly lines and fintech hubs, North Carolina and South Carolina have captured projects that will shape construction, labor markets, and economic development for years. At the same time, policy actions from Washington are influencing costs, energy planning, and labor supply—making adaptability the watchword for firms delivering these projects.

Data Centers Dominate the Headlines

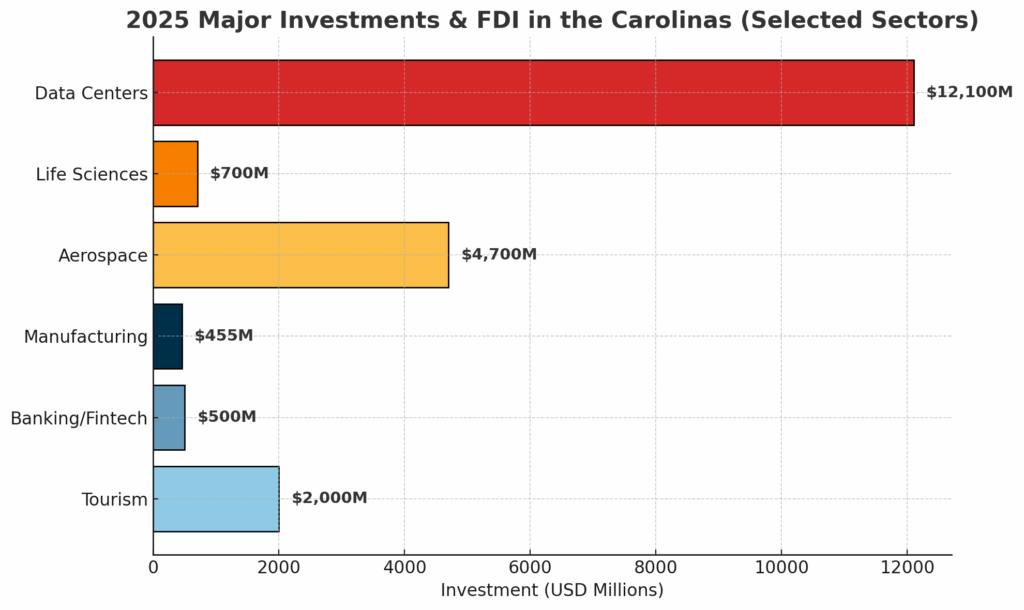

North Carolina landed one of its largest economic development deals in history in June when Amazon Web Services announced a $10 billion cloud and AI campus in Richmond County, NC, projected to create more than 500 jobs. Governor Josh Stein described it as “a historic investment that demonstrates confidence in North Carolina’s workforce and our technology ecosystem.” For builders, the project translates into multi-phase site preparation, heavy electrical and mechanical trades, and massive utility coordination over several years.

South Carolina matched the momentum with Cielo Digital Infrastructure’s $2.1 billion, four-building data center campus in Cherokee County, SC, announced this summer. Governor Henry McMaster celebrated it as proof that “high-tech companies can thrive in the Palmetto State.” Commerce Secretary Harry Lightsey added that the deal reflects the growing ability of rural communities to compete for advanced investment. Construction scope will be expansive, including substations, large-footprint data halls, and long-lead electrical systems.

These announcements come against the backdrop of rising power demand. Earlier this year, South Carolina lawmakers approved a 2,000-megawatt natural gas project led by Dominion and Santee Cooper to ensure grid reliability. Data center development has been a central driver of the state’s push for dispatchable energy capacity, signaling that utility alignment will remain critical for developers and contractors.

Life Sciences Expand Their Presence

North Carolina’s reputation as a life sciences leader was reinforced in May when Genentech announced a $700 million biomanufacturing facility in Holly Springs, NC. The project is expected to create around 400 jobs with salaries averaging $120,000. Life sciences construction brings unique challenges: cleanroom trades, high-spec piping and process systems, and stringent validation requirements. For the state, the deal underscores a cluster effect as firms continue to gravitate toward the Research Triangle for its talent, research institutions, and infrastructure.

Aerospace and Advanced Manufacturing Fly Higher

In June, JetZero chose Greensboro’s Piedmont Triad International Airport for a $4.7 billion blended-wing commercial aircraft factory, the largest job-creating project in North Carolina’s history. Up to 14,500 jobs are expected over time. “From first in flight to the future of flight,” said Governor Stein, framing the project as a milestone in the state’s aerospace trajectory. The deal will ripple through supply chains, driving demand for composites, tooling, logistics, and housing in the Triad.

Meanwhile, PPG committed $380 million to expand its coatings plant in Shelby, while AVL Manufacturing announced a 325-job plant in Charlotte, NC. These moves reflect a wave of supplier and reinvestment projects anchoring the Carolinas’ manufacturing base. South Carolina has also seen steady inflows, including Rolls-Royce’s $75 million expansion in Aiken County, SC and new European and Asian entrants such as Eurocharm Group of Taiwan, SCHNEEBERGER of Switzerland, and CS Instruments of Germany. Collectively, these investments highlight the Palmetto State’s long-standing strength in attracting foreign manufacturers and integrating them into its export-driven economy.

Banking and Fintech Add Fuel in Charlotte

Charlotte’s reputation as a banking capital received a boost in July when Citi announced a 510-job technology hub in the city. Chris Chung, CEO of the Economic Development Partnership of North Carolina (EDPNC), emphasized the dual benefits of jobs and ecosystem development, noting that “this selection will not only create quality jobs but also elevate the region’s overall economic vibrancy.” Construction activity tied to the hub will include retrofitting office space for advanced IT systems and potentially developing new cyber and training facilities.

Tourism Remains a Cornerstone

Tourism continues to be a pillar in South Carolina, even as national leisure spending moderates. Charleston’s $14 billion tourism economy and Myrtle Beach’s 18 million annual visitors remain central to local tax bases. Myrtle Beach also ranked as Tripadvisor’s top U.S. beach destination for summer 2025. Although early indicators suggested some caution in traveler spending this year, the sector continues to sustain hospitality construction, renovations, and municipal projects along the coast.

Policy Crosswinds from Washington

While the Carolinas attract record deals, national policy developments are influencing the landscape. The Trump administration has moved aggressively on trade and energy. A June executive order on trade enforcement has heightened expectations of expanded tariffs, which could raise steel, aluminum, and copper costs by as much as 10%. Contractors are already reporting early signs of upward pricing.

Labor policy is also playing a role. A July rule extending supplemental H-2B visas provided some relief for seasonal and specialty contractors, but stepped-up enforcement has tightened labor supply in certain regions. For construction leaders in the Carolinas, this means schedule risk is as much about workforce availability as it is about design or materials.

Energy policy intersects directly with the Carolinas’ ambitions. Federal actions promoting domestic energy production have aligned with South Carolina’s push for more natural gas generation to support data centers. At the same time, Governors Stein and McMaster jointly urged the administration to maintain the moratorium on offshore drilling in the Atlantic, citing risks to tourism and fisheries.

Key Trends Emerging in 2025

Several themes stand out from the Carolinas’ deal pipeline this year:

- Data Center Acceleration: Driven by AI workloads, cloud demand, and national utility strategies, the Carolinas are becoming prime ground for hyperscale investment.

- Life Sciences and Aerospace Strength: These industries continue to cluster in North Carolina, leveraging research institutions and advanced manufacturing capabilities.

- Manufacturing Reinforcement: Both states are landing major reinvestments and supplier expansions, particularly from European and Asian firms.

- Finance and Technology Fusion: Charlotte remains a financial hub while drawing fintech and technology jobs that diversify its economy.

- Tourism Dependence: South Carolina continues to rely on a resilient leisure economy, anchoring service jobs and construction activity along the coast.

Executive Perspectives

Leaders in both states have been vocal in celebrating 2025’s wins. Governor Stein cast Amazon’s investment as transformative for AI-era growth, while Governor McMaster hailed Cielo’s project as proof that high-tech companies can succeed in South Carolina’s pro-business climate. EDPNC’s Chris Chung emphasized the quality jobs and long-term growth prospects tied to Citi’s Charlotte hub, and Secretary Harry Lightsey pointed to South Carolina’s FDI record as a competitive differentiator.

For construction executives, these statements highlight the importance of aligning with state incentives, workforce development pipelines, and site-readiness programs. Incentives and training are becoming as critical as land and power in winning projects.

Bottom Line for Builders

The Carolinas’ 2025 ledger reflects both breadth and depth: hyperscale data centers (AWS, Cielo), life sciences (Genentech), aerospace (JetZero), industrial reinvestments (PPG, Rolls-Royce), and finance-tech (Citi). Combined, these deals position the region as one of the most attractive in the U.S. for capital investment.

The outlook is not without risks. Rising tariffs, labor shortages, and input price volatility threaten margins, while a softer national economy is beginning to cool confidence. Still, backlogs in the South remain among the highest in the nation, and state competitiveness is at the top of national rankings—North Carolina was again CNBC’s top state for business in 2025.

For executives in the Carolinas, the path forward is clear: leverage strong demand, manage costs through early procurement and prefabrication, align closely with utilities and workforce programs, and prepare for policy swings from Washington. Those who can adapt quickly and strategically will not just weather the crosswinds—they will be positioned to thrive in one of the nation’s most dynamic construction markets.