The Fed Hits the Brakes and Construction Takes it on the Chin

News that October existing home sales fell once more, giving a period of decline dating back to January 2022, is a reminder that when the Fed hits the brakes, it is housing and the construction economy that feels the sharpest pain. As National Association of Realtors chief economist Lawrence Yun put it: “More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher.”[i] Of course, there is more to the story than just housing, as important as that sector may be, and efforts by the Fed to cut the growth of money in the economy in order to tame inflation, this after having accelerated the economy the year before in order to ease COVID-induced hardships.. There are also rising construction materials costs, scarce skilled labor, and limited availability of properly zoned land, water and sewer capacity.

So given this picture, what can we say about our immediate situation and the prospects for 2023?

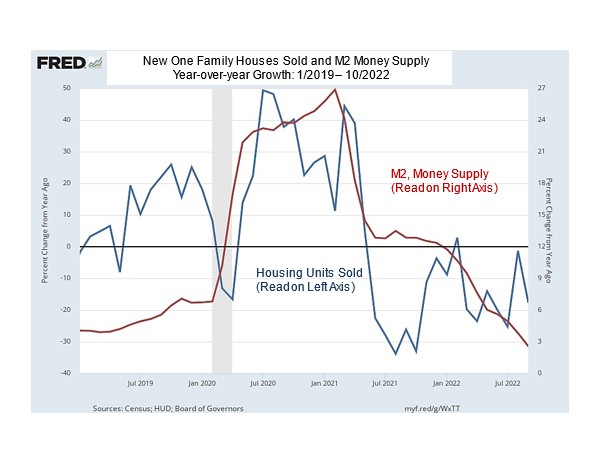

Taking a closer look at the relationship between money in the economy, which the Fed and politicians in power control, and new home sales nationwide, one can quickly see how Washington’s effort to ease COVID’s pain by shipping out trillions of dollars to consumers and businesses triggered a burst of construction activity and home sales. The same picture also tells that when the Feb began to hit the brakes, what had been a construction boom slowed significantly.

This is seen clearly in the nearby chart that maps data on M2, a common measure of money circulating in the economy, and monthly sales of new single-family housing units in the United States for the period January 2019 through October 2022, all on the basis of year-over-year monthly growth rates.

Looking at the chart, I first call attention to the red line that reports money supply growth. Notice the explosive growth that begins in mid-2020 and continues till early 2021. This is when trillions of dollars were pumped into the economy. Then, note how money supply growth falls and then plummets as the Fed hits the brakes in 2022. Now, take a quick look at the blue line, which measures growth in monthly new home sales, and see how real estate markets responded to the “helicopter” money that was dropped into the economy. Then, take a look at what happens when the Fed hit the brakes hard and all the fun came to a screeching halt. The data tell us that with M2 growth heading south, growth in new home sales and related construction will continue to fall.

But what about the effect of all this on the larger economy, on inflation, and the prospects for 2023? We know that construction activity is slowing and with that a fall in the number of people employed in construction for both the nation and for South Carolina. For September, S.C. construction employment was down 7.2 percent from a year earlier.[ii]

Will inflation give up? And will we suffer from a hard recession any time soon?

We should first note a bit of good news. Inflation as measured by the Consumer Price Index and Producer Price Index is now falling. We don’t have enough data points to call this a trend, but enough to feel better about future prospects. In looking at data on money supply growth and inflation, I find that inflation, which now runs at better than 8.0 percent annually, should hit 3.0 to 3.5 percent about this time next year. At that same time, the national economy will likely be operating in negative growth territory. Whether that is called a recession will be determined later, but given what the data tell us now, we can surely expect 2023 to be a weak growth year, barely positive overall, with negative growth in the latter half.

So as the 2022 economy approaches year-end, we are getting mixed signals. Overall economic activity is holding up rather well. There is still a lot of money in the consumer’s piggy bank. But the money is being drawn down. Interest rates are up and are destined to rise some more. As a result, construction is down and will become weaker in the months ahead. Meanwhile, the prospects for lower inflation are looking better, but the prospects for the overall 2023 economy show considerable weakness in next year’s latter half.

Bruce Yandle is Alumni Distinguished Professor of Economics Emeritus, Clemson University, and Distinguished Adjunct Fellow with the Mercatus Center at George Mason University where his quarterly Economic Situation Report is posted.

[i] https://tradingeconomics.com/united-states/existing-home-sales.

[ii] https://www.sccommerce.com/sites/default/files/2022-10/Economic_Outlook_October_2022.pdf.