The U.S. Economy and Prospering Carolinas

With fall approaching and football upon us, our national economy continues to respond to almost daily policy shocks as the Trump administration constantly unveils major changes.[1] Federal departments are being shuttered, a global trade war is underway, thousands of undocumented workers are being arrested, jailed and deported, and the economy is still adjusting to shocks generated by COVID. Add to this, wars in the Middle East and Ukraine and the rise of artificial intelligence that is dramatically changing how information is stored and used and one can begin to see that our world is going through a wringer of change.

Now, as I catch my breath, I hasten to point out that the national economy has proved its resilience in the face of all this, and, amazingly enough, is breathing rather well. Even though heavily affected by top-down government management, markets have continued to adjust, real GDP is still being produced, which means the nation can pay its debts, and inflation seems finally to be coming under control. In a few words, the economy is hunkering down for a year or so of constrained growth.

Let’s focus first on the nation and then put the spotlight on the two Carolinas. When we do, we will see that where we live matters a lot. In a word, the Carolinas are doing well.

The U.S. Economy

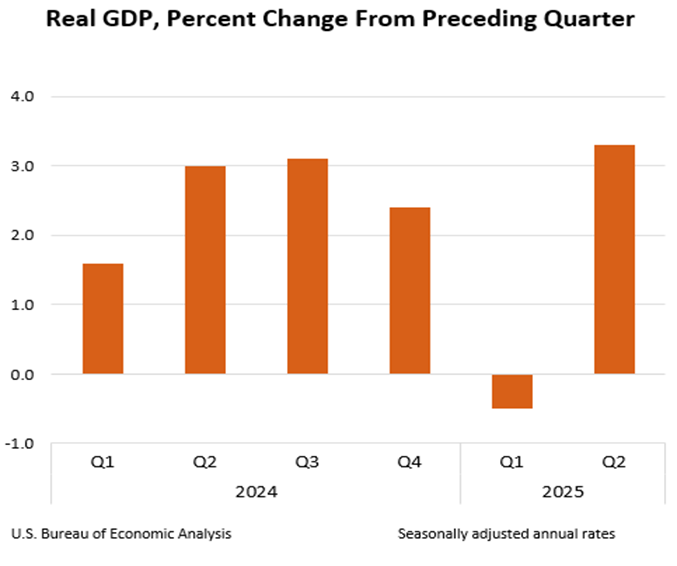

We see evidence of some of this for the nation in the Commerce Department’s estimate for second quarter real GDP growth that came in at a healthy 3.3 percent shown in the next chart.

The 3.3 percent combined with the first quarter’s shrinking, −0.5 percent growth, yields a two-quarter average of 1.4 percent, a low growth rate but one that compares with what three major forecast groups are predicting for the year ahead.

In the next table, I report estimates provided by the Philadelphia Fed, The Wall Street Journal, and Wells Fargo Economics. I note that there are no negative numbers. The slowing effects of tariffs are the kicker, and we are just now getting a final determination of what those border taxes will be for our major trading partners.

Real GDP Growth Forecasts

| 3Q-2025 (%) | 4Q-2025 (%) | 1Q-2026 (%) | 2Q-2026 (%) | |

| Philadelphia Fed | 0.9 | 1.4 | 1.7 | 1.9 |

| Wall Steet Journal | 0.9 | 1.1 | 1.6 | 1.9 |

| Wells Fargo | 1.2 | 0.7 | 1.4 | 2.9 |

Sources: Federal Reserve Bank of Philadelphia, “Second Quarter Survey of Professional Forecasters,” May 16, 2025, https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q2-2025; Anthony DeBarros, “About the Wall Street Journal Economic Forecasting Survey,” Wall Street Journal, July 12, 2025, https://www.wsj.com/economy/economic-forecasting-survey-archive-11617814998; Wells Fargo, “U.S. Economic Forecast,” https://wellsfargo.bluematrix.com/docs/html/88d2eafa-3a64-4cca-b013-4093132d9c99.html, August 5, 2025.

How about the Carolinas?

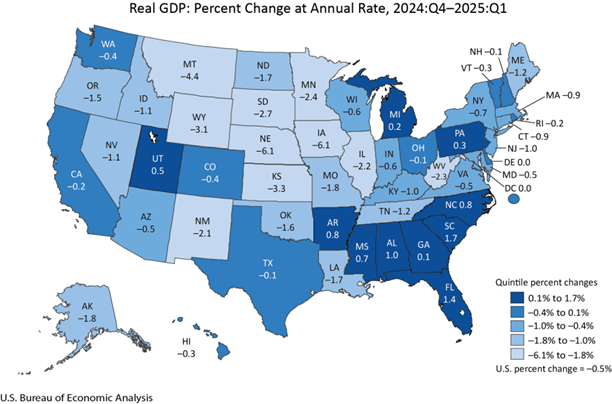

Those of us who feel fortunate to call the Carolinas home recently received strong evidence that we had made an economically healthy choice. In a Commerce Department report on state GDP and income growth for 2025’s first quarter, South Carolina led the nation with 1.7 percent GDP growth and North Carolina came in 4th with 0.8 percent. Recall, this compares to -0.5 percent growth experienced by the nation. Real estate development was the strong contributor to the Carolinas’ surge; and that includes strong construction activity. As the nearby map reports, the Southeast is by far the nation’s healthier section.

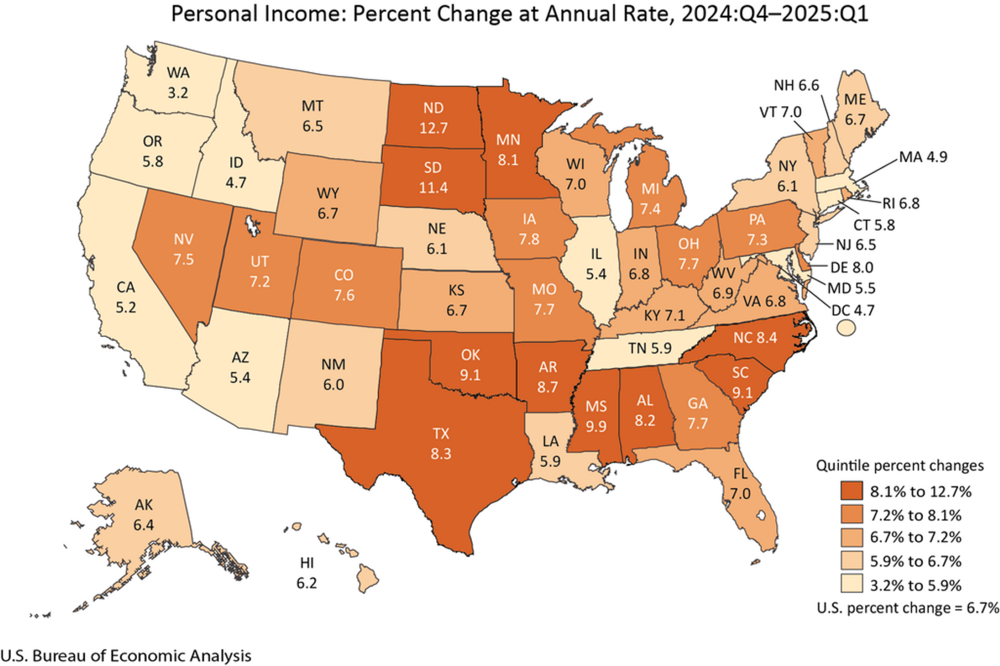

The same Commerce Department announcement reported on state income growth, which can differ significantly from GDP growth. Income includes retirement, investment and transfer payments in its calculation where GDP is the market value of all newly produced goods and services. As shown in the next map, South Carolina tied with Oklahoma for the 4th spot; North Carolina held the 6th highest position.

Construction Effects

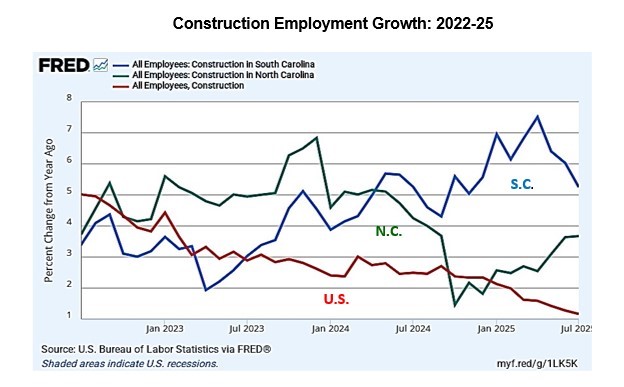

Evidence of the Carolinas’ high performance is seen in growth in construction employment. As shown in the accompanying chart, employment growth has been most robust in South Carolina while growth for North Carolina has also outstripped the national pace, which has been falling for a year.

Looking ahead

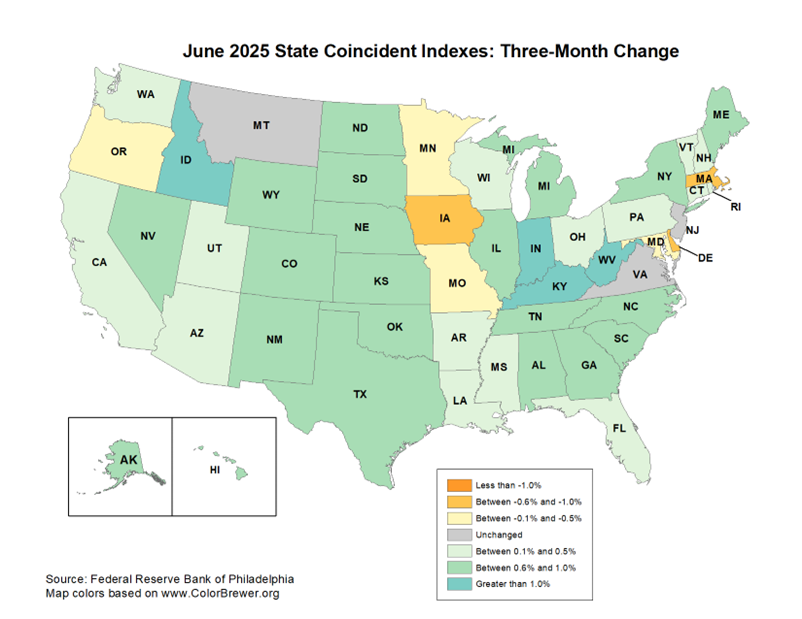

Although recent, the GDP and income growth numbers still give a rear-view mirror reading on how the Carolinas are doing. We get a picture of the future by way of state leading indicator maps produced by the Federal Reserve Bank of Philadelphia. The underlying data for these maps are based primarily on labor market activities in the form of nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and the sum of wages and salaries with proprietors’ income. Statistical treatment of these data generates a three-month leading indicator.

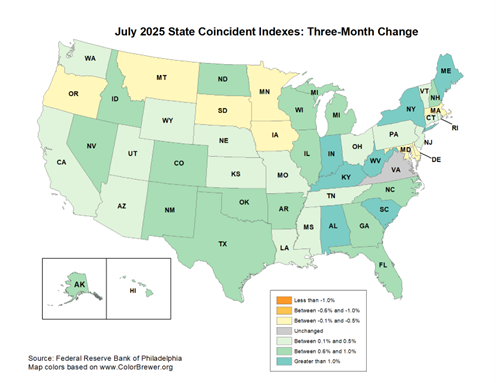

I next provide two maps, one for July 2025 and for June 2025, so that comparisons may be made. As can be seen, South Carolina is in the high-performance category for July. North Carolina ranks in the second highest category. I point out that the Southeast is a solid performing region. A quick comparison with the June map tells us that South Carolina’s leading indicator has gotten stronger, while North Carolina has held its own.

Taken together, the geographic data lead to a positive forecast for economic performance in the Carolinas for the year ahead.

Final Thoughts

As we approach 2025’s final quarter, we have a national economy that is weakly producing prosperity and major U.S. regions that are doing remarkably well. That said, because of the frequency and severity of policy changes occurring, we have a situation where decision makers face high uncertainty. When uncertainty is high, geographic moves tend to be postponed, and major investments and expansions tend to be put on hold. The economy is hunkering down.

We face a serious challenge, to say the least, as we search for patterns of behavior that might assist in predicting where the Trump White House will take this hunkered down economy in the next few years. Based on actions taken so far, we may conclude that we are observing a revised form of capitalism involving heavy state activity that goes beyond taxes, subsidies, and old-fashioned regulation.

We now see the federal government taking equity ownership in new and existing corporate ventures, sharing in the profits of others, and calling for changes in management of still more. There is no avowed commitment to hands-off free market activity with this new state-assisted capitalism. Instead, the overriding commitment seems to revolve around requirements of “pay-to-play” for countries that seek to do business in America and tariff-based penalties for nations that displease White House leadership. So, while this may not be the best of all possible worlds, it is still one where many creative, hard-working people find a way to a better life. And that’s saying a lot.

[1] This piece draws on the author’s September 2025 Economic Situation report posted on the Mercatus Center’s website. See https://www.mercatus.org/scholars/bruce-yandle.