The U.S. Economy and the Carolinas at Mid-Year

Special to GroundBreak Carolinas: Dr. Bruce Yandle, Alumni Distinguished Professor of Economics Emeritus, Clemson University, shares economic insight for construction leaders in the Carolinas.

Getting Started: The Current Picture

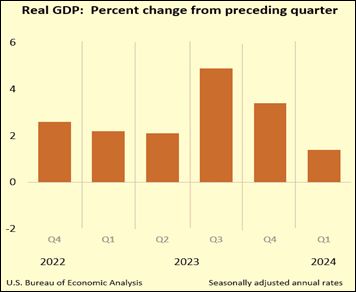

With 2024 at the halfway mark, we find a national economy registering a low pulse-beat and an improved outllook on the inflation front. First quarter real GDP growth came in at a weak 1.4%,[i] and the Federal Reserve’s preferred inflation metric for May, the Personal Consumption Expenditure Index, hit 2.6% growth for the second month hand-running. This was the lowest annual inflation rate since 2021. The weak south-bound GDP growth seen in the nearby chart is well below the long-term 2.0% average registered over many decades.[ii] The declining GDP growth rate and the lower inflation reflect the Fed’s effort to bring down inflation by way of higher interest rates. In spite of all this, we still have positive growth with prospects for staying above zero for as far as the eye can see.

While the Fed has been hitting the brakes, and apparently is not quite ready to ease back, the White House and Congress have been putting the inflation pedal to the metal. It’s an election year, and politicians love to print money to fund favorite programs for those who might help them remain in office. Financing deficits by way of the printing press yields more inflation. I note that in the same week the Commerce Department reported an improving inflation outlook, the Congressional Budget Office released an update to its 10-year budget projections boosting its fiscal-year 2024 U.S. budget deficit estimate to $1.9 trillion, up from $1.5 trillion in its February projections.[iii]

When we look closely at forecaster estimates, like those of The Wall Street Journal, Federal Reserve Bank of Philadelphia and Wells Fargo Economics, we see a slow economy but no prospects at this point for a 2024-25 recession. Of course, with presidential debaters scowling and town halls howling, how could we forget that this is crazy season on the political front and both presidential candidates are busy making promises that, if delivered, would bring unpredictable change, maybe boom, maybe bust? In a word, we live in a risky world.

Since the Fed started hitting the brakes, interest rates on a 30-year, fixed-rate mortgage have bounced from the high-2% territory in 2020 to 7.0% in May 2024. As expected, housing starts have taken it on the chin. The Census Bureau reports that “privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,277,000…, 5.5% below the revised April estimate of 1,352,000 and 19.3% below the May 2023 rate of 1,583,000.[iv] We should also recognize that the resulting higher costs for shelter feed into estimates made for the Consumer Price Index. The Bureau of Labor Statistics recently reported that “the [CPI] for all items less food and energy rose 3.4 percent over the past 12 months. The shelter index increased 5.4% over the last year, accounting for over two thirds of the total 12-month increase in the all items less food and energy index.”[v] Efforts to limit inflation sometime add to it.

How Does it Look Across the States?

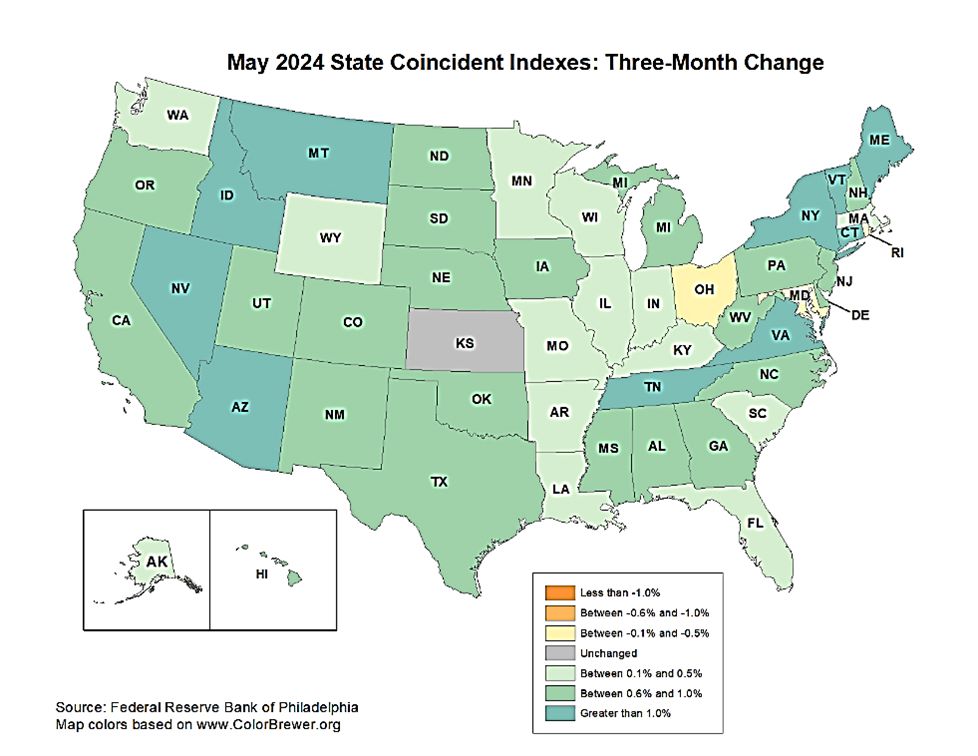

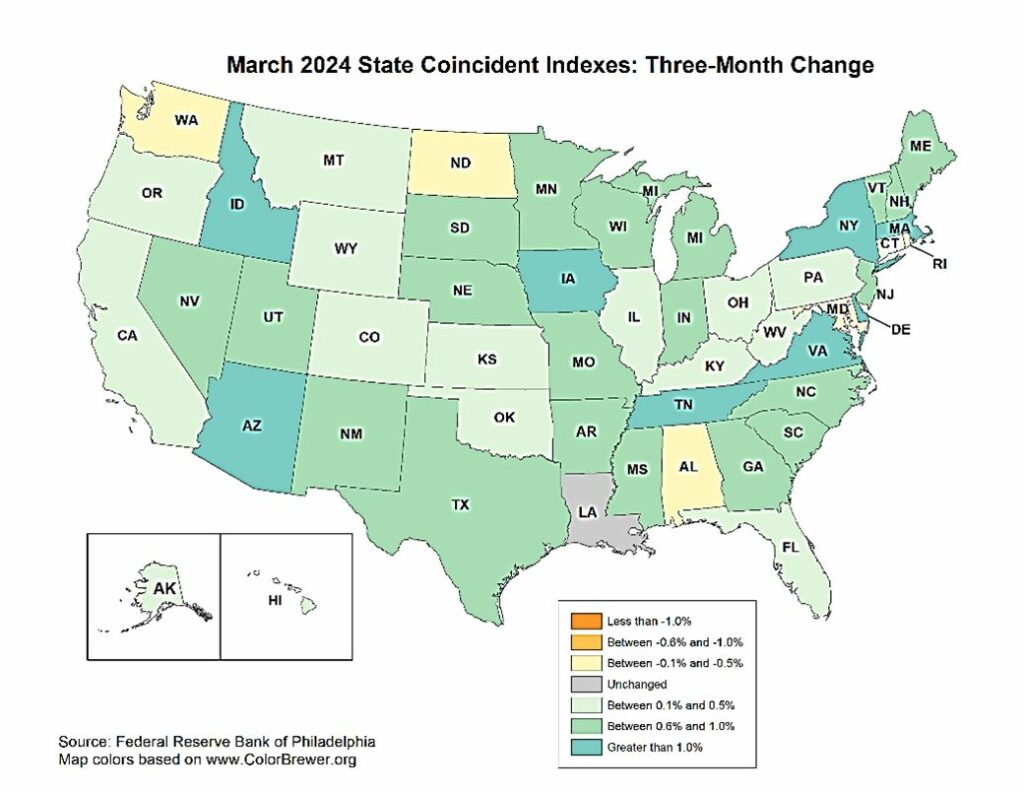

All of this and more is registered in economic indicators across the 50 states as reported by the Federal Reserve Bank of Philadelphia.[vi] In the next two charts, I show data for May and March 2024. Taking a look, we see a fairly pleasant picture. I call attention to the dominant green hues in both maps; these reflect positive growth. I also note that the picture for May is better than for March. While noting this, I offer a bit of a warning. The latest employment and retail sales data suggest the economy is getting weaker, not stronger, and that we should see the results of this in future maps.

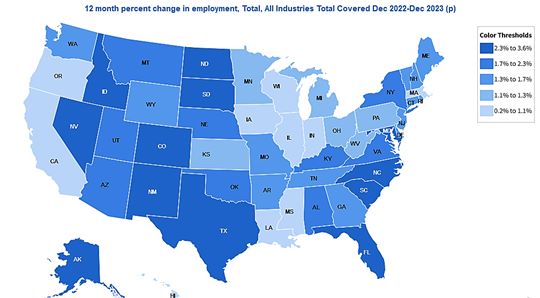

Taking a look at 2023 employment growth across the 50 states, we get another positive picture. I next provide data from the Bureau of Labor Statistics. I note that the two Carolinas rank highest east of the Mississippi.[vii] Indeed, one has to travel to Nevada (3.6%), Idaho (3.5%) and North Dakota (2.7%) to find higher growth rates.

I also note that Texas, Florida, North Carolina, South Carolina and Tennessee were the top five destination states for U-Haul customers in 2023.[viii] People respond positively to employment opportunities.

Can We Find a Better Way Forward?

Since 2008 the American people have endured two severe recessions, an economy-closing pandemic that took the lives of more than one million people, disrupted energy and other supply chains that came with Russia’s invasion of Ukraine, a serious bout with double-digit inflation generated by government efforts to ease the pain that came with the pandemic, and an explosion of new federal top-down regulation. Through it all, what remains of a market-driven economy has adjusted amazingly well. Employment growth has strengthened, wages are catching up with inflation, and new business formations are taking place at record levels.

We are also witnessing productivity improvement delivered by accelerated use of drones for managing construction projects and growing use of artificial intelligence triggered in turn by the development of high-powered chips and cloud computing. Dealing with the disruptions and crises has identified people and organizations that are flexible, nimble on their feet and ready to take on the challenges coming in the year ahead. This is a time, it seems, to get ready and following the advice of Voltaire’s Candide, tend our garden.

Dr. Yandle’s June 2024 Economic Situation Report may be seen at https://www.mercatus.org/scholars/bruce-yandle.

[i] https://www.bea.gov/news/glance, https://www.fxstreet.com/news/us-gdp-growth-for-q1-revised-higher-to-14-as-expected-202406271235

[ii] https://www.clevelandfed.org/collections/speeches/2023/sp-20230516-longer-run-trends-us-economy#:~:text=Over%20the%20long%20term%2C%20the%20U.S.%20economy%20has,in%20the%20U.S.%20has%20been%20falling%20over%20time.

[iii] https://www.cbo.gov/publication/60039

[iv] https://www.census.gov/construction/nrc/current/index.html

[v] https://www.bls.gov/news.release/pdf/cpi.pdf

[vi] https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/state-coincident-indexes

[vii] https://data.bls.gov/maps/cew/us

[viii] U-Haul Announces Top Growth States of 2023 | U-Haul (uhaul.com)