The US Economy at Mid-Year: What about the Next Six Months?

At this 2023 mid-point, a close look at the U.S. economy reveals uncertainty, bumps in the road ahead, and an economy that is so shot full of federal government intervention and stimulus that it is difficult to determine what is real and what is artificial.[1]

Some but not all of this is understandable. After all, we are still feeling the effects of the 2008-2009 Great Recession, the COVID pandemic, and massive deficit-spending actions taken to cushion pandemic effects. Add to this the Russia/Ukraine war, America’s ongoing battle with inflation, and difficulties faced by banks worldwide from rising interest rates and we get a witch’s brew that can hardly be fully understood.

Looking at the U.S. Economy

On considering all this, I think we can conclude:

- The U.S. economy now reflects a dominant Administrative State where every major sector and industry is subject to significant political directive and control. In very real sense, there is no free-wheeling private sector. Government is now an integral part of the functioning economy.

- The combination of shocks and responses, especially from the Great Recession, ended what had been enthusiastic support for globalization. Globalism has been replaced by nationalism that emphasizes domestic production and deemphasizes international trade beyond North America and long-standing trade partners.

- The Federal Reserve’s anti-inflation actions have led to a run-off of federal debt instruments from the Fed’s balance sheet and contributed to a sharp decline in the money supply, reductions in the market value of bank assets, tightening of lending standards and slowing housing construction.

- The rise of the gig economy with more remote work taking place leaves underutilized commercial space in major cities and a redistribution of work activities that favors smaller cities and less congested regions like the Southeastern United States and the Carolinas.

- Massive federal spending for infrastructure will stimulate civil and large public construction projects.

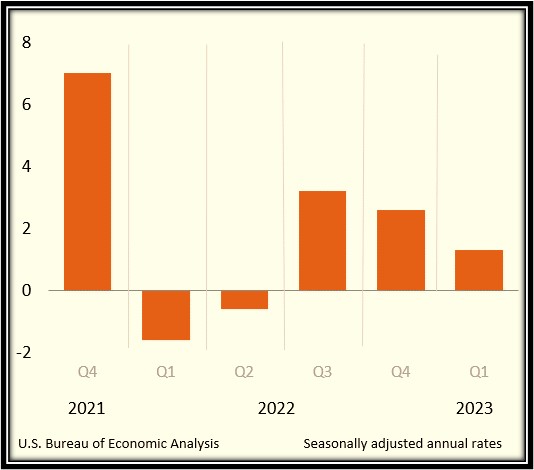

The conditions just summarized have spawned a roller-coaster economy with large swings in real GDP growth shown in the nearby figure. Now, the recently received second estimate for 2023’s first quarter shows a small 1.3 percent growth.[2]

Real GDP Growth

Recession?

At this point, most major forecasters call for a recession in the next six to nine months.[3] For example, the most recent Federal Reserve Bank of Philadelphia’s February survey of 37 forecasters indicated negative real GDP growth in this year’s third quarter.[4] Earlier, a January Wall Street Journal (WSJ) survey of 79 economists predicted negative GDP growth in 2023’s second quarter, and third quarter growth at almost zero.[5] In a more recent, April survey, that same WSJ panel moved the recession’s start to the third quarter.[6] And last November, Wells Fargo economists predicted negative GDP growth for this year’s third and fourth quarter, a recession forecast that has not been altered.[7] I expect we will see negative ink in this year’s fourth quarter and 2024’s first quarter. At this point, I do not expect the slowdown to be a large one. Indeed, it might not even qualify for classification as a recession.

Unfortunately for inflation-weary consumers, the first quarter Personal Consumption Expenditure Index increased 4.2 percent, compared with the fourth quarter’s increase of 3.7 percent. In spite of this reading, however, it is clear that major strides have been made in reducing the growth of the Consumer Price Index. There is hope that we will see 2.5 percent inflation in early 2024.

What about the Southeast and the Carolinas?

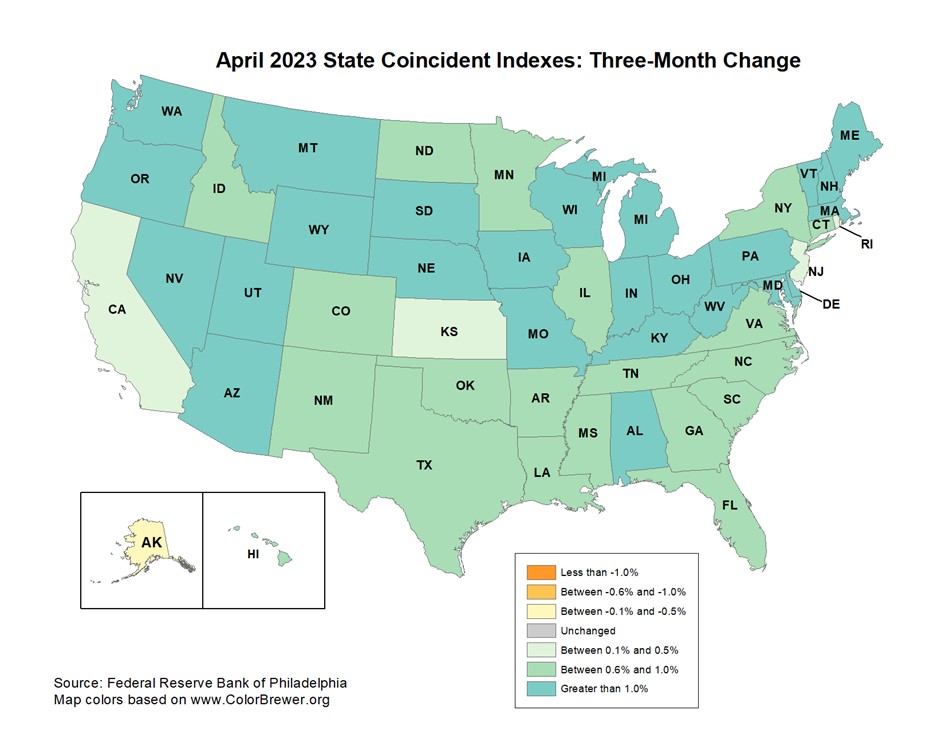

The effects of the Fed’s continuing efforts to slow the economy while somehow avoiding a recession are now being seen in declining job openings, reductions in building permits issued, and layoffs across many large employers, especially in the financial services area. As shown in the nearby map produced by the Federal Reserve Bank of Philadelphia, we are not seeing negative effects in April’s overall state economic indicators.[8] I note that the darker the shade of green, the better. At this point, the Southeast looks healthy.

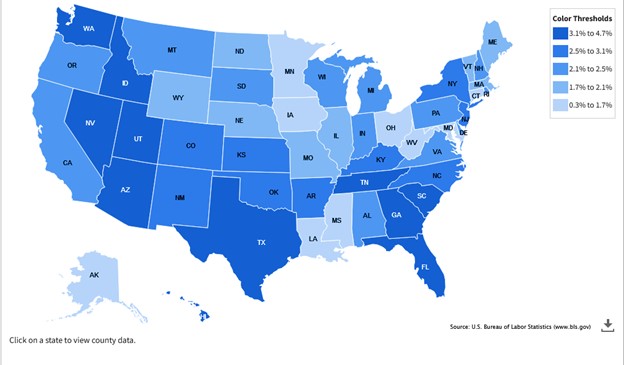

We get a similar picture when we examine the Bureau of Labor Statistics most recent employment growth data through December 2022 and shown in the next chart.[9] As indicated, the Southeast is the strongest U.S. region east of the Mississippi River.

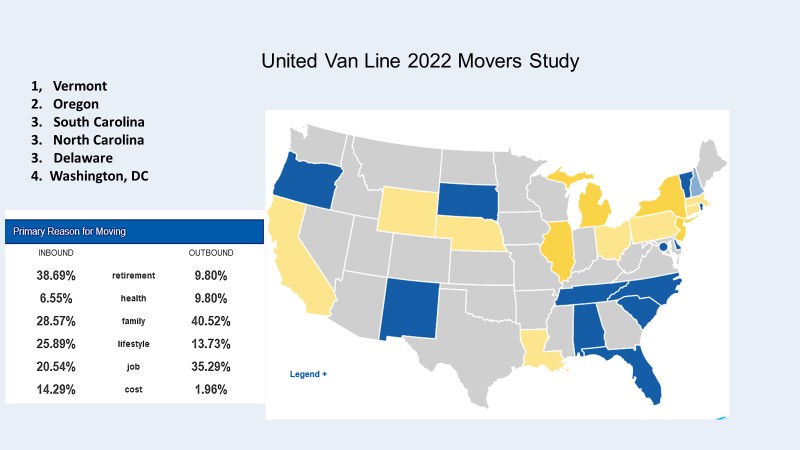

Finally, we have another optimistic take on the region and especially the Carolinas in data from the latest United Van Lines Mover Study shown in the nearby chart.[10] Notice that the Carolinas tie for third place in terms of more people preferring to move in than move out.

While all this looks good and calls for lots of smiley faces, I must report that April 2023 residential building permit data for the two Carolinas show a decline from a year ago. April was the first negative report for North Carolina. South Carolina’s permit growth turned negative in September 2022. When employment data are examined, we find growth in both states began to weaken in 2022’s second quarter. Employment growth is still positive for North Carolina, but has turned negative for South Carolina.

Final Thoughts

As noted at the outset, the U.S. economy is reeling from political and economic shocks that go back to 2008 and are as fresh as yesterday. With such massive shock and intervention, it is risky to rely on past methods for forming a forecast of what we may be experiencing over the next six months. But I will do it anyway.

First, I expect GDP growth for the nation will continue to bounce along a line headed toward negative territory, and that we will experience negative real GDP growth between now and June 2024. Second, I expect we will see inflation fall toward 2.5 percent before June of next year and that the unemployment rate will tick up to 4.0 percent. Construction activity will be stimulated overall by infrastructure spending, with much of the activity coming from state and local activity. Residential construction activity will be in a state of decline.

While the nation adjusts, the Southeast and the two Carolinas will adjust, too. Affected by negative national and international forces, these regions still have a force with them that will soften those negative effects, but not eliminate them. The region and the two states will continue to be counted among the strongest parts of the United States economy.

Dr. Bruce Yandle is Alumni Distinguished Professor of Economics Emeritus, Clemson University.

[1] Parts of this are based on Bruce Yandle, The Economic Situation, June 2023, https://www.mercatus.org/scholars/bruce-yandle.

[2] https://www.bea.gov/data/gdp/gross-domestic-product.

[3] https://www.bea.gov/news/2023/gross-domestic-product-first-quarter-2023-advance-estimate.

[4] https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q1-2023.

[5] https://www.wsj.com/articles/economic-forecasting-survey-archive-11617814998.

[6] https://www.wsj.com/articles/economists-turn-more-pessimistic-on-inflation-ed2fd667.

[7] https://wellsfargo.bluematrix.com/links2/html/da774168-1eb5-436b-bef3-0a2429d7fa33l, https://wellsfargo.bluematrix.com/docs/html/f316aabc-ad95-4966-b3c6-7d4369ab6ea0.html.

[8] https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/state-coincident-indexes.

[9] https://data.bls.gov/maps/cew/us.

[10] https://www.unitedvanlines.com/newsroom/movers-study-2022.