The Year Ahead: The Economic Situation and Prospects for the Carolinas

Election Day is behind us and though not in office until January, President-elect Trump is already taking action to deliver on his campaign promises. Along with stated plans to deport illegal immigrants, cut taxes, and bring about an early end to war in Ukraine and Gaza, “Tariff man,” as he likes to style himself, has promised substantial border tax increases on all goods coming from Mexico, Canada and China. Making good on that promise raises serious economic issues for the nation and especially for the two Carolinas.

Trump put it this way: “On January 20th, as one of my many first Executive Orders, I will sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States.”[1] He went on to include China. These three countries are top destinations for goods produced in the Carolinas, two of the most international economies in the nation. When wars, hurricanes, strikes and COVID’s lingering effects are considered, what can we say about the outlook for the U.S. economy and the Carolinas?

First, consider the nation. The Department of Commerce indicates third-quarter real GDP growth—driven by strong consumer spending—cranked along at a healthy 2.8% pace, slightly lower than second quarter’s 3.0%, but still a good number.[2] Whether measured by the all-item Consumer Price Index or the Fed-preferred Personal Consumption Expenditures Price Index[3], inflation has fallen into the low-2% range.[4] The unemployment rate is happily staying in the low-4% range[5], and though fluctuating from month-to-month, Consumer Confidence, up strongly in October and November,[6] is resting at a comfortable, almost just-right level.[7]

In short, though still juiced by stimulus money from federal efforts to offset COVID, the U.S. economy is beginning to look almost normal again. But after a year-long Fed effort to bring down inflation with high interest rates, housing sales and starts are down, and auto sales have been falling since January 2024.[8] Indeed, construction activity growth, though positive and healthy in many areas, is slowing.

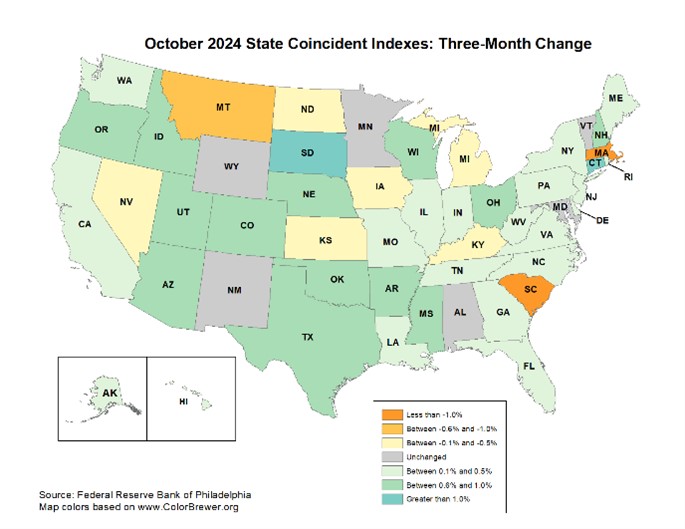

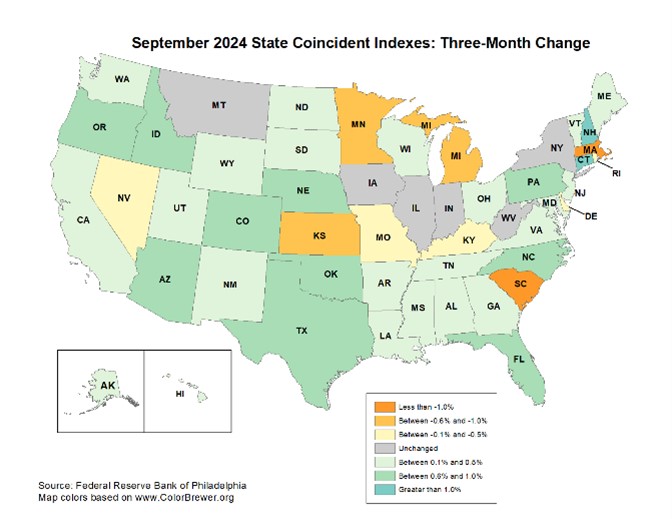

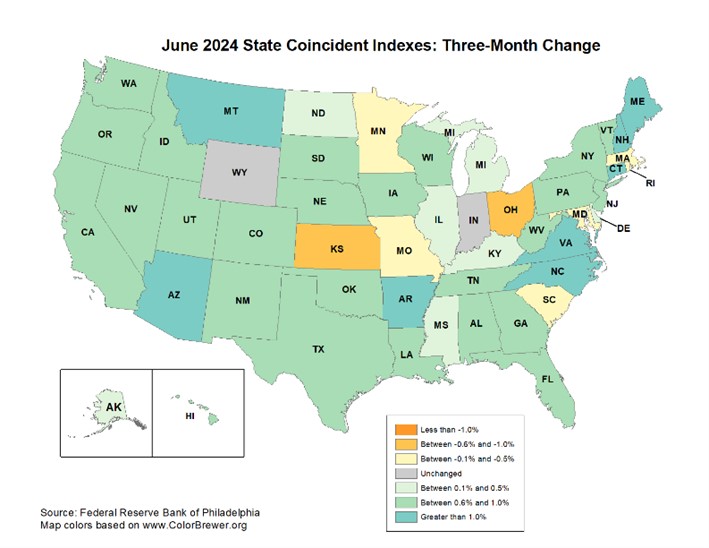

Looking at some maps

We get a visual interpretation of these forces by way of state coincident economic indicator maps produced by the Federal Reserve Bank of Philadelphia.[9] Below, I show maps for October 2024, September 2024, and for comparison purposes, June 2024. The October/June comparison shows how the economy has weakened following months of higher interest rates. The October/September pairing tells how and where the economy is still weakening. A look at all three maps identifies the weaker U.S. regions. Weakest seems to be centered in the Illinois-upper Midwest neighborhood. Generally, the southern half of the United States, or sunbelt region, has fared better, but the Carolinas and Georgia show recent weakness.

With Federal Reserve data for the most recent 12 months, the next chart shows year-over-year employment growth for all U.S. construction employment along with heavy and civil and residential construction employment. Here, we see the positive 2023 of COVID stimulus on public sector construction that then weakened and the hammering residential construction felt from high interest rates. Employment for all three sectors is now growing but at a declining annual rate.

The year ahead

Now, let’s look ahead. Consider what three forecast organizations are saying about the year ahead. In the next table, I show GDP forecasts for the next four quarters for the Phladelphia Fed’s economics panel, The Wall Street Journal economist survey, and Wells Fargo Economics. I call attention to how closely nested the forecasts are and note that The Wall Street Journal forecast was made prior to Election Day. Wells Fargo economists explicitly included a tariff-driven reduction in their estimate for 2025’s last half. I note that none of the forecasts sees negative real GDP growth for the next 12 months. Of course, any number of economic shocks could affect these numbers. We also might need to be reminded that GDP growth is determined by how many people go to work each day, and that number is falling. As The Wall Street Journal’s Mary O’Grady recently noted, America needs to import people because we don’t make enough of them here anymore.[10] But GDP growth is also strengthened by productivity gains that come from investment in new capital, including intellectual property rights, which is currently a strong GDP driver.

Table 1: GDP Growth Estimates

| 4Q 2024 | 1Q 2024 | 2Q 2025 | 3Q 2025 | |

| Philadelphia Fed | 1.7% | 1.7% | 1.8% | 2.2% |

| Wall Street Journal | 1.7% | 1.7% | 1.9% | 2.0% |

| Wells Fargo Economics | 2.0% | 2.4% | 1.5% | .7% |

https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q3-2024. https://www.wsj.com/politics/elections/economists-say-inflation-deficits-will-be-higher-under-trump-than-harris-0365588e?mod=article_inline. https://wellsfargo.bluematrix.com/links2/html/05ca4b0c-2522-4b31-a2c1-1bcca918664d

As “Tariff Man” returns, the Carolinas better fasten seat belts

If there was any doubt about President-elect Donald Trump’s tariff plans before, there shouldn’t be now. As indicated recently, instead of tackling the immigration and drug problem by way of legislative reform and domestic law enforcement, he will take an authoritarian approach and keep his promise to raise tariffs on goods crossing American borders: Stated as a bargaining position, Trump indicates that the tariffs will stay in place until the border countries stop the U.S. flow of illegal drugs and undocumented immigrants.

Once announced, however, tariff talk in one country always brings tariff talk in response. Retaliation is the norm, and trade wars the result. Both Mexico and Canada have been quick to remind Trump that a tariff war will hurt the United States just as it will hurt them, though not to the same degree. And of course, U.S. consumers will bear part of the burden of related price increases. U.S. workers that produce goods shipped to tariff-targeted countries and their employers also can be hurt when retaliation takes hold. Those states that are most international in character are at greater risk.

But what about the Carolinas? Do their economies face a new risk?

Of the 50 states, in August 2024 North Carolina was the number 14 in total exports from the United States.[11] Top country destinations for N.C. exports by rank were China, Canada, Mexico, and France. South Carolina, in August 2024 was ranked 17th nationally; the state’s top export destinations were Germany, Canada, Mexico, and South Korea. On the import side of the ledger, China, Ireland, Mexico, China and Germany are the top ranked sources of North Carolina imports.[12] China, Germany, Mexico and Canada are top import sources for South Carolina.[13]. As to total employment supported by international trade, in 2023 the share of the workforce supported by international trade stood at about 20% for both Carolinas.[14] As to workers employed with foreign-owned firms, in 2021, South Carolina was number one in the nation with 9.2% and North Carolina was in the Top 10 with 6.2% of its workforce so employed.[15]

Obviously, the two Carolinas are highly vulnerable to economic difficulties that can emerge from a U.S. trade war with Canada, China, and Mexico.

Final thoughts

As we stand at 2025’s threshold, the nation’s economy looks okay, not great, but okay. Lots of important economic indicators are headed in the right direction. In recent years, the two Carolinas have enjoyed almost surging prosperity. Indeed, in both 2022 and 2023, the two states ranked in the top five U-Haul destinations.[16] But when we carve deeper into the 50-state data, we find weaker regions and sectors along with evidence of rising uncertainty. President-elect Trump has raised the prospect of a trade breakdown or war that involves Canada, Mexico, and China. Exports to these three countries play a significant role in the economies of the two Carolinas. Imports from those same countries are important, too. Yes, what we have right now are threats. Meanwhile, caution lights are lit, and seat belts should be fastened.

[1] https://currently.att.yahoo.com/news/trump-ups-ante-tariffs-vowing-001501760.html?.tsrc=daily_mail&uh_test=1_11&.tsrc=daily_mail&segment_id&ncid=crm_-1295960-20241126-214&bt_user_id=fJiAbTJTf7Wg1AqiNhBFLFFTOiXcYz4RsYnexkiWg1ElfWlGBHkv2wR%2B5I%2FKdKYk&bt_ts=1732610039909

[2] https://www.reuters.com/markets/us/us-third-quarter-economic-growth-unrevised-28-2024-11-27/

[3] https://www.cnn.com/2024/10/31/economy/us-pce-inflation-fed-spending-september/index.html

[4] https://www.marketplace.org/2024/10/30/federal-reserve-preferred-measure-of-inflation-pce/

[5] https://www.bls.gov/news.release/empsit.nr0.htm

[6] https://www.conference-board.org/topics/consumer-confidence

[7] https://www.conference-board.org/topics/consumer-confidence

[8] https://fred.stlouisfed.org/series/DAUTOSA

[9] https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/state-coincident-indexes

[10] https://www.wsj.com/opinion/americas-immigration-conundrum-the-us-needs-more-people-job-market-border-crisis-577929e2

[11] https://oec.world/en/profile/subnational_usa_state/nc

[12] https://oec.world/en/profile/subnational_usa_state/nc

[13] https://oec.world/en/profile/subnational_usa_state/sc

[14] https://www.usglc.org/state-facts/south-carolina/.https://www.usglc.org/state-facts/north-carolina/

[15] https://www.bls.gov/spotlight/2019/a-look-at-employment-and-wages-in-u-s-establishments-with-foreign-ownership/. https://www.bea.gov/news/2023/activities-us-affiliates-foreign-multinational-enterprises-2021

[16] https://www.uhaul.com/Articles/About/U-Haul-Announces-Top-Growth-States-Of-2023-30660/