Trump Uncertainty and Prospects for the 2025 Economy

In office just over a month, Donald J. Trump is delivering on his promises and disrupting the national, if not the world economy. He promised border enforcement, deportations, tariffs, lower taxes and “draining the D.C. swamp” of federal workers and expenditures. He is delivering on these promises and more. But almost always there are delays, reversals, and refinement that lead to rising uncertainty. Indeed, Trump is using policy uncertainty as a negotiating device when seeking to get what he has promised or wants. Let’s see if we can figure out what is going on.

For example, instead of moving forward immediately with his promised tariffs on Canadian, Chinese and Mexican imports, Trump imposed tariffs on steel and aluminum and indicated he would keep the world guessing about the rest. In a similar way, the 90-day freeze imposed on most foreign aid by the State Department may be seen as drawing a line from which new deals will be made before aid at some level resumes. A similar pattern is seen for employment buyouts and agency closings. In a way, an “elephant-in-a-china-shop” approach is being taken with some corrections made after the damage is done.

On an almost daily basis, large policy boulders are dropped into the economic sea, unaccompanied by oil to soothe troubled waters. In any case, whether it be firing several thousand federal employees, closing agencies, taking over Greenland, making Canada the 51st state, ending Daylight Savings Time, leaving the World Health Organization, asserting control of the Panama Canal, ending the EV mandate, or revitalizing Gaza as a Riviera on the Mediterranean, we can be certain of one thing: there is uncertainty as far as the eye can see.

Reading uncertainty

And just how much uncertainty is there?

The next chart reports weekly readings for the Economic Policy Uncertainty Index, which is based on a count of key words in major daily newspapers. Notice how the index has risen sharply since the Trump election. It is now almost as high as on January 8, 2021, the date of the Washington insurrection. High uncertainty leads to delays in investments and major spending decisions, and that reduces GDP growth. But what about construction and regional vulnerabilities for damages from a growing trade war and federal employee layoffs?

Already in a slowdown due to high interest rates and rising material costs, the construction industry nationwide is highly vulnerable to employment losses associated with deporting foreign-born workers. Of almost 30 million foreign-born workers—both legal and undocumented—employed in the United States in 2023, 3.3 million worked in construction, the third largest affected sector. This followed 5.5 million in education and health and 4.7 million in professional and business services. Fewer than a million were employed in agriculture. We should expect to see rising wages as firms attempt to replace displaced workers.

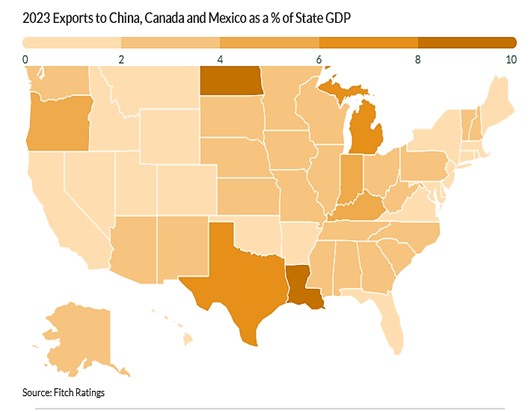

What about trade wars that may ensue? States with the largest export sectors will be most vulnerable to harmful trade-war effects. The next map reports the share of state GDP accounted by export sales to Canada, China, and Mexico. These three countries account for 40% of all exports to the United States. Note that the two Carolinas and Georgia have exports hitting in the 2.0% to 3.5% GDP range, yielding low but still meaningful vulnerability. It should be remembered that we are considering the value of all newly produced goods and services, the very heartbeat of a state economy.

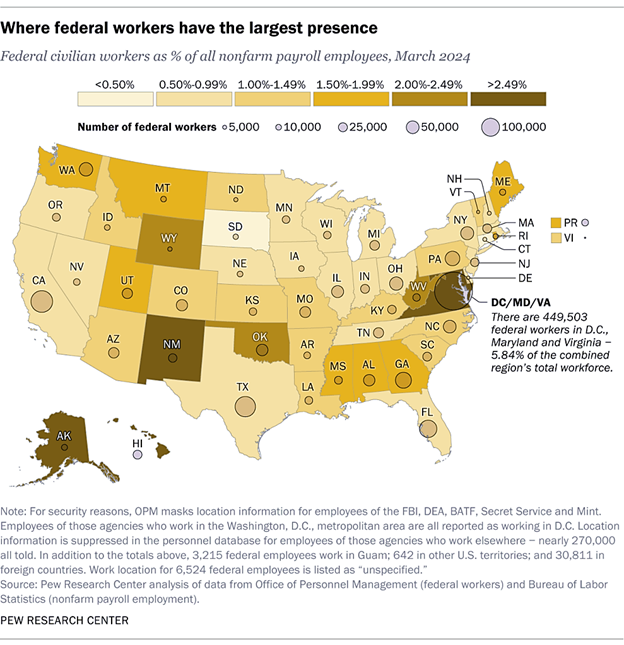

Finally, consider regional vulnerabilities to cuts in federal government employment. Assuming that higher levels of federal employment mean more risk to economic harm from layoffs, the next chart reports 2024 federal employment share for the states. Georgia is most vulnerable state in the region.

Economic prosperity: the shock absorber

As we attempt to sort out the economic effects of the Trump disruption, it should be noted that the overall outcome could be positive for the national economy, all things considered. (Warning: my mother loved me a lot when I was little, so I tend to be optimistic.) Reducing deficits and bringing federal spending into balance with revenues by itself will lift prosperity’s future prospects. Using tariffs to negotiate reductions in border taxes imposed by other countries while offering some protection to vulnerable industries can yield a mixed outcome with the possibility that the pluses will be larger than the negative effects. And, of course, lifting the burden of federal taxes and regulation while advancing government effectiveness offers a more prosperous future.

All things considered, however, we end where we started. There is policy uncertainty as far as the eye can see. We have no choice but to adapt and look for opportunities for positive gain, while we attempt to protect ourselves from the harmful effects generated as our world finds a new equilibrium.