U.S. Put-in-Place Construction Forecasts – Winter 2024

ConstructConnect Projects US Put-in-Place Construction Spending of $2.15 Trillion in 2024

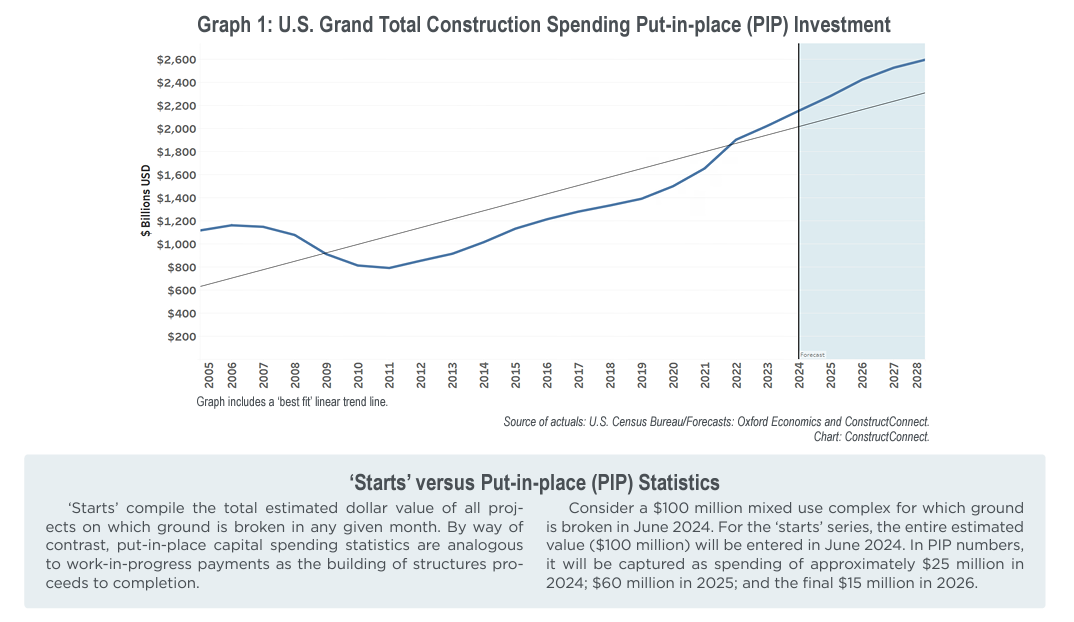

ConstructConnect Chief Economist Michael Guckes released the US Put-in-Place Construction Forecast for Winter 2024 today. According to the report, total put-in-place construction spending for 2024 is expected to reach $2.15 trillion, marking a 6.4% increase from 2023.

Although slightly lower than the last quarterly projection of $2.16 trillion, this updated US Put-in-Place estimate reflects steady growth driven by several overarching trends.

These trends include government stimulus spending, shifts in international supply chains, and construction projects related to the electrification of the economy.

Guckes added that emerging from these trends, we have seen Construction Starts reflect a surge in spending across heavy engineering, industrial, and power infrastructure categories over the past two years.

Three Trends Shaping Construction Growth

The Rise of Megaprojects

Over the last 12 months, megaprojects—projects valued at more than $1 billion—accounted for 18% of all nonresidential construction spending, up from around 10% just five years ago. Guckes reported that growth has been particularly evident in heavy engineering, industrial, and power infrastructure projects.

Due to their scale and extended timelines, megaprojects are expected to enhance put-in-place results in the coming years significantly.Industrial Construction on the Rise

The industrial sector has experienced a tremendous boom. Annual construction starts more than doubled from $66 billion in 2021 to $151 billion in 2022 and $133 billion in 2023. Guckes noted that industrial put-in-place spending is projected to reach a record-breaking $232 billion by the end of 2024.

While spending levels are anticipated to decline gradually in the following years, they are forecast to remain robust, ending 2028 at $208 billion, still more than twice the 2021 level.Electrification of the Economy

The accelerating electrification of the economy is fueling substantial investment in power generation and related infrastructure. ConstructConnect projects spending to hit $150 billion in 2025, with annual growth pushing expenditures to a record $245 billion by 2028.

Graph of US Put-in-Place construction spending, where 2024 investment is expected to reach $2.15 trillion, a 6.4% increase from 2023. Image: ConstructConnect

The Big Picture

Beyond these sector-specific trends, Guckes indicated that structural factors remain favorable for the construction industry. The delayed effects of stimulus spending, paired with anticipated economic stabilization through falling interest rates and slower wage growth, are expected to support growth. Additionally, modest pricing movements for construction materials may further alleviate cost pressures.

“These trends demonstrate the ongoing resilience and adaptability of the construction sector,” Guckes reported. The economist added, “Owners and developers will continue transferring record amounts of capital to their construction partners as these megaprojects progress.”

Market Trends

Guckes has noted that these forecasts highlight the significance of understanding construction market trends across industries. Engineering activity, for example—particularly in power infrastructure, communications, and broader heavy engineering—remains an opportunity to explore.

ConstructConnect’s Put-in-Place Construction Forecast provides a five-year forecast of work-in-progress payments across 18 construction categories in the residential, commercial/industrial, and infrastructure sectors. This allows professionals to make informed decisions and seize opportunities in an evolving market.

To explore more detailed data and analysis, download the Winter 2024 Put-in-Place Construction Forecast.

About ConstructConnect

Construction Starts Here™ at ConstructConnect, where our mission is to help the construction industry start every project on a solid foundation. A leading provider of software solutions for the preconstruction industry, ConstructConnect empowers commercial construction firms to streamline their workflows and maximize productivity. ConstructConnect operates as a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the Nasdaq 100, S&P 500, and Fortune 1000.